In this Post:

- A Few Tips to Improve Your Credit

When you just filed bankruptcy, available credit cards are few and far between. In fact, one of the questions people ask me is: “How can I get a credit card to repair my credit if my credit is bad? Another question people often ask me is: “How can I get a credit card to repair my credit if my credit is so bad that no one will take a chance on me?”

It does seem like a catch-22. With bad credit unsecured credit cards are almost impossible to find. If you do find them the fees are outrageous. If you’ve tried for an account and failed, naturally you will be frustrated! When your credit report shows late payments, defaults, bankruptcies, or other such negative data, your credit rating won’t exactly inspire faith. Lenders would be wise to reject an application for an unsecured credit card because it screams “risk!”They’ve got to protect their bottom line against loss, after all. That is why bankruptcy credit cards are so hard to find.

And that’s why I’m always thrilled to provide the following answer: “With a secured credit card!” The beauty of these accounts for consumers is two fold.

- One, with bankruptcy credit cards that are secured qualification is fairly easy.

Typically, all you need is a job and perhaps a couple of hundred dollars to put down as collateral. This way the issuer can feel safe that if you charge but don’t pay, they can just take the money owed out of the funds held in the deposit account. No revenue wasted on phone calls and letters, having to sue you for damages or selling the account for less than it’s worth to a collection agency. Sometimes, as little as $50 can get you bankruptcy credit cards that are secured!

Two, once you have the card, you can use it to your advantage.

Sure, you may have horrible credit now because of all that past activity, but with the secured credit card, you will be able to add fresh and wonderful information to your credit reports! All you have to do is charge a small amount every month and then pay it on time and in full. As long as the issuer is a subscriber to the three major credit bureaus (always check that they are before applying), your credit rating will improve. After twelve months, you’ll be surprised by how your credit score shoots up with that simple set of actions.

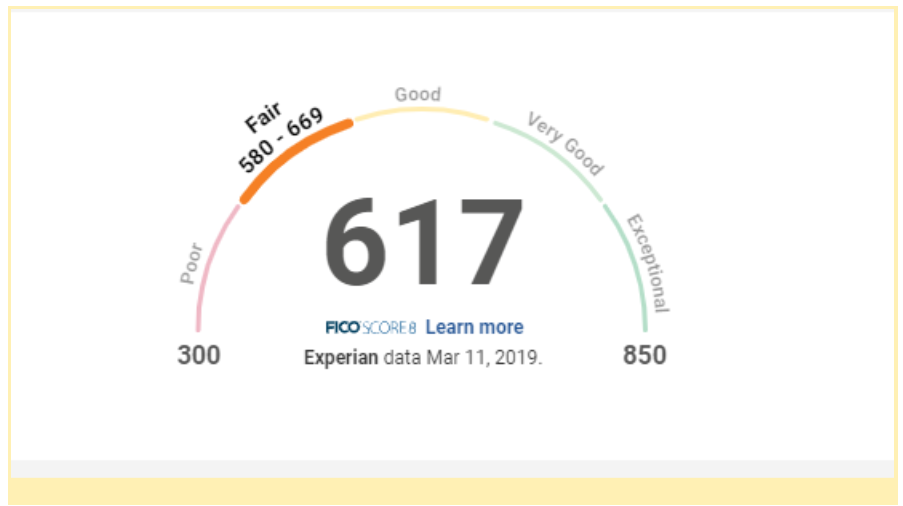

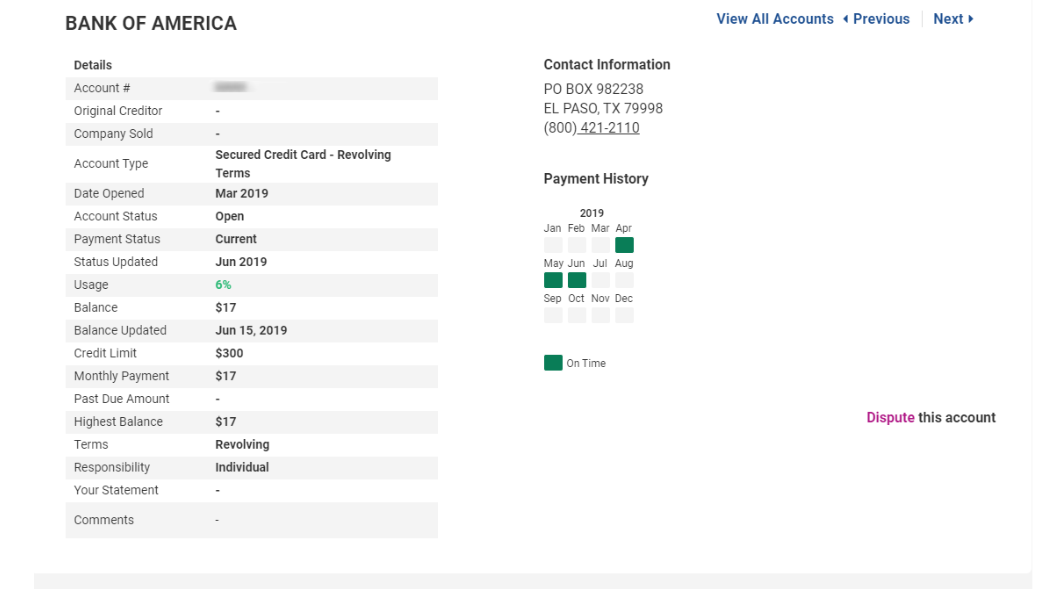

Customer approved for secured card with a 617 credit score.

You do have to be dedicated to using the card right, though. Pay attention. Set up automatic bill pay with your bank and monitor your progress.

After that, add another secured card to your wallet so your scores will improve faster. “Types of credit in use”is a FICO scoring factor, and that gauges the number and variety of credit instruments you have. A few in use is helpful. More, your credit report won’t show that they are any different from unsecured accounts, so you’re not penalized for having to put down collateral.

A Few Tips to Improve Your Credit

If you have any recent but unpaid collection accounts, pay them off now. The newest version of FICO won’t factor them in, as long as they’re satisfied. Get back on track with payments on all other liabilities – such as car and student loans – if you have them, too.

Then wait. Most negative information drops off a credit report after seven years (Chapter 7 bankruptcy remains for ten years) but as the bad marks age and the good ones are constantly appearing, you’ll see incredible changes. Eventually all that will show up on your credit report and be factored into your scores will be what you’re doing with active accounts and closed ones in positive standing.

Use your secured credit card well and you will soon have the entire world of credit issuers at your doorstep.