In this Post:

- Median Score in a Nutshell

- Determining Your Median Score

- 2 Different Types of Score

- Calculating Your Average Credit Score

- Your Median Score Has Impact

Your credit score has a huge impact on whether or not you get approved for a mortgage. You may wonder which credit score is used for a mortgage. But here’s the thing — you don’t have just one credit score. There are many different types of credit scores, but the most popular one is the FICO credit score.

There are three credit bureaus — Experian, TransUnion, and Equifax — who gather data, and each has their own FICO score. These FICO scores may not be the same and when a mortgage lender, and sometimes an auto lender, reviews these scores, they’ll go with the middle credit score.

What does that mean and how does it impact you?

Learn more about the middle credit score and how it works.

What Is a Median Score and Why Does It Matter?

When a mortgage lender reviews your FICO credit score, it’s likely they pull information from all three credit bureaus. These credit bureaus can have different FICO credit scores.

Why?

Because not all creditors or lenders report information to every credit bureau. Or, each credit report may be updated at different times which can impact a score.

In other words, there are a few reasons why your credit scores from each credit bureau are similar but not the same.

However, since there are three different FICO scores for a mortgage lender to look at (this is the most common usage) they will look at the middle credit score.

The middle score is sometimes referred to as the median score, as it’s the number in the middle when looking at data points.

Overall, the median credit score in the US has been around 700 for the past decade.

How to Figure out Your Median Score

How can you figure out your middle/median score? First you need to review all of your credit scores. The lender will choose the middle score out of the three FICO scores — one from each credit bureau — not the lowest, not the highest, but the middle score, to determine your eligibility.

So let’s say your credit scores are:

- 720

- 710

- 680

From lowest to highest, that would be:

- 680

- 710

- 720

The lender would choose the middle score, in this case, 710, to assess your eligibility for a mortgage. Mortgage lenders have credit score requirements that determine eligibility, so they want to see where you are at.

The Difference Between Your Average and Median Score

Using the middle score to determine eligibility is a common practice in the mortgage industry and to a lesser extent, auto lenders. However, some lenders use your average credit score instead of the middle score/median score.

If you go back to your days of learning math, the term average and how it’s calculated might ring some bells.

Finding the average means adding all of the components together and dividing by the number of components.

So let’s go back to our example:

Your three FICO credit scores are:

- 720

- 710

- 680

Added all together, the total is: 2,110.

Taking the sum of 2,110 and dividing it by 3 (the number of credit scores) equals: 703.

As you can see there’s a slight difference between your middle/median score and your average credit score.

In this case, the middle credit score is 710 while the average credit score is 703, amounting to a seven-point difference.

How to Estimate Your Average Credit Score

If you want to know the range of your FICO credit scores, you can get a free estimation using this myFICO calculator.

- You may also want to check all three of your credit reports and see the credit scores available to figure out both your middle score as well as your average credit score.

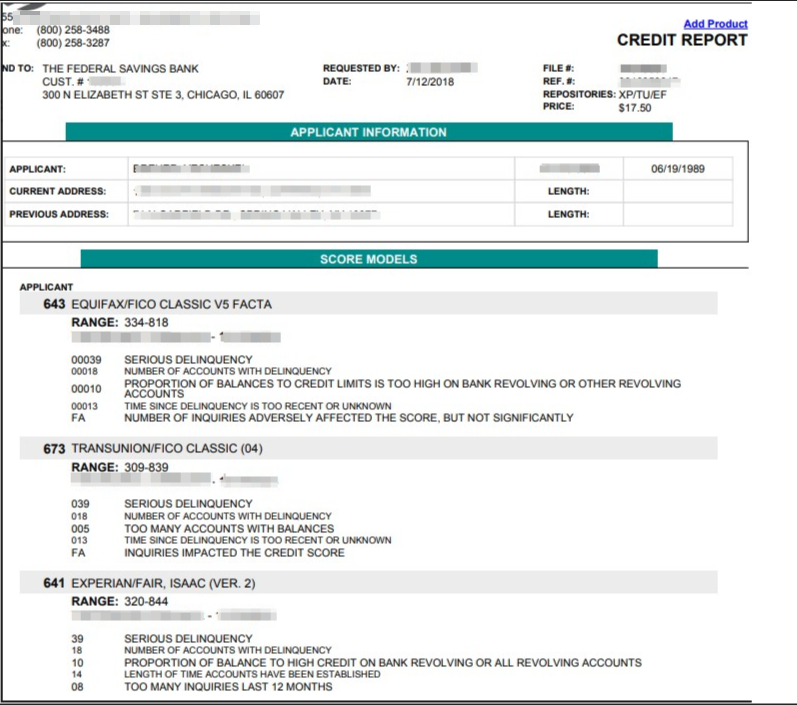

As you can see in Figure 1.1, there is a FICO credit score associated with each one of the credit bureaus. They are 643, 673, and 641. From lowest to highest, the middle score would be 643.

Figure 1.1 Credit report with all three credit scores, one from each credit bureau.

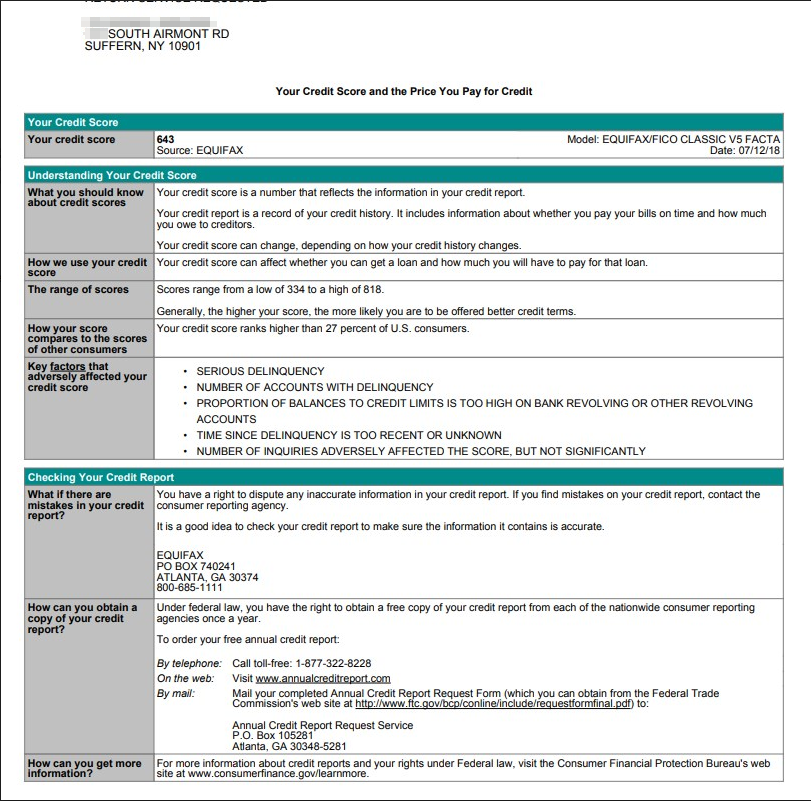

In Figure 1.2 you can see the middle score of 643 from Equifax, which is the number a mortgage lender would be likely to review.

Figure 1.2 The middle score.

Your Median Score Can Impact Your Finances

Now that you know what the middle/median score is and how it’s used, you want to be sure to keep your credit scores in shape.

Applying for a mortgage, or any type of loan, is a big milestone. Your credit scores determine your interest rates. Those interest rates can have a huge impact on how much you pay overall, and you want to get on the right foot and not pay more than you need to.

Make sure to pay your balances on time. Keep your balances low. Only borrow what you need.

Sticking to these principles can keep you in good standing so when your middle score is pulled, it will work in your favor.