In this Post:

- Payment history on your credit report

- Payment history — the most important part of your credit score

- How a missed payment affects your credit score

- Getting a missed payment off your credit report

Have you just been turned down for a credit card or a loan? Or is your credit score lower than you thought it was?

That may not be the best news.

But the good news is that you can raise your credit score a lot by taking care of your payment history.

What is that?

Making your credit card and loan payments on time — what the credit bureaus call “payment history.”

Payment history on your credit report

Payment history refers to whether you pay your bills, and if you do, whether you pay the amount due and on time.

Your payment history is the most important information a lender can have about you. It tells lenders how you’ve handled credit in the past — which is usually a good indicator of how you’ll handle credit in the future.

Making on-time payments plays an important role in improving your credit score because it shows lenders that you handle credit responsibly. If you’ve had a late payment here or there, that alone won’t necessarily tank your credit score. But even one late payment could lower your score. It’s also good for you to know that the more recent a late payment is, the more it affects your credit.

Here's why:

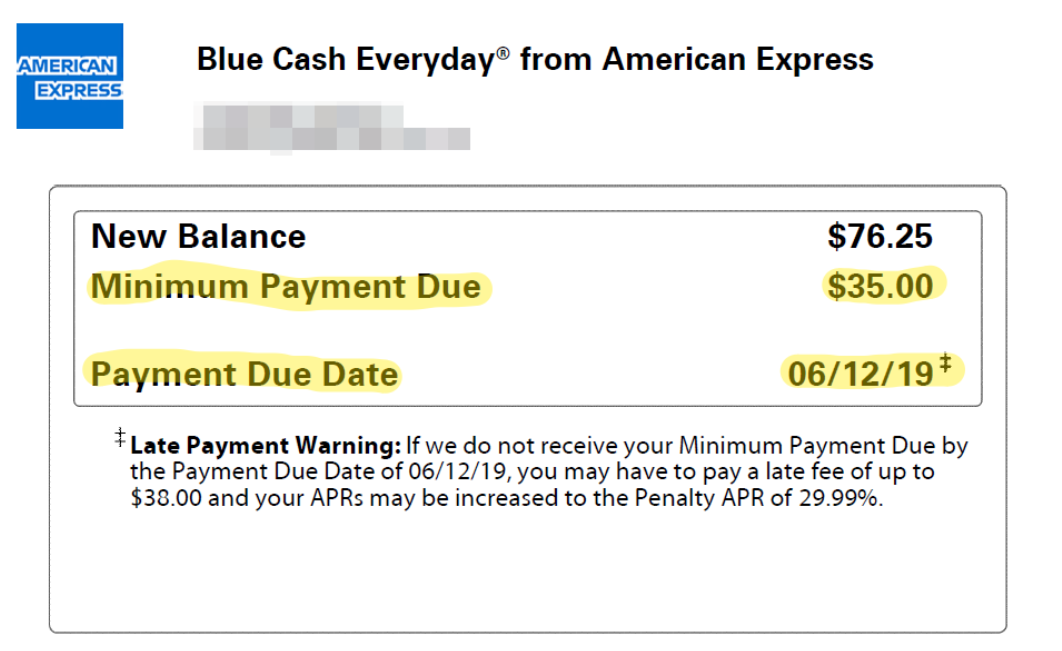

If you get a late payment on your credit report from a credit card issuer, for example, it means you were over 30 days late. If you were less than 30 days late, that is not reported to the credit bureaus. So if your credit report shows you have a late payment (or payments) on your credit card, lenders know you were significantly late.

The takeaway here is that making on-time payments definitely has a positive effect on your credit score, but missing payments has a negative effect. And the later you are with a payment, the more your score will decrease.

For all you perfectionists out there who are trying for a perfect credit score, please note that payment history isn’t the only factor that affects credit score. Therefore, you won’t necessarily have a perfect credit score even if you always make on-time payments: There’s a lot more involved.

Here are some factors which also affect your credit score:

- Debt on revolving credit cards

- Your credit mix of mortgage, credit card, and lease/loan history

- Credit age

- Amount of inquiries on your credit report

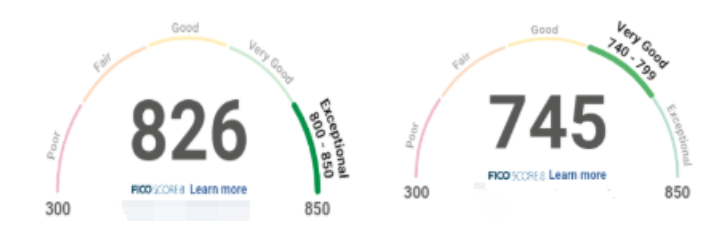

The truth is, though, that you don’t need a perfect FICO score. Once you reach close to 800, you’re in the highest possible category anyway.

Payment history — the most important part of your credit score

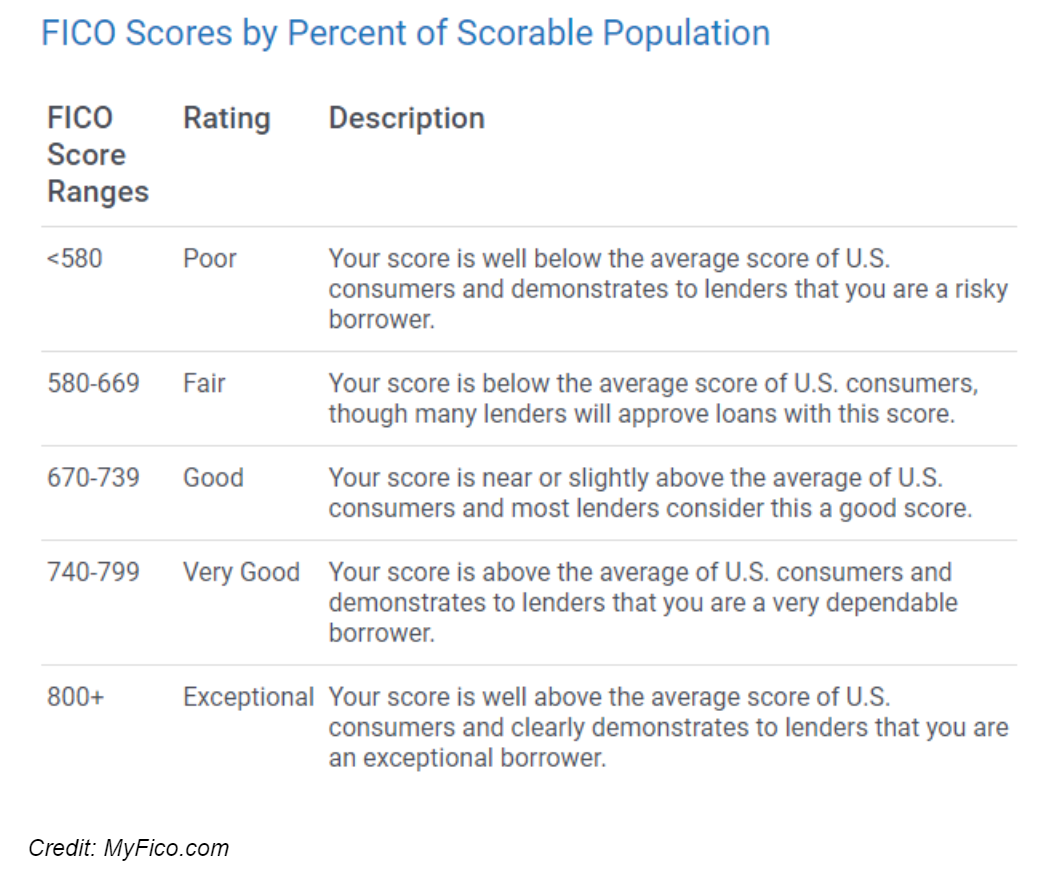

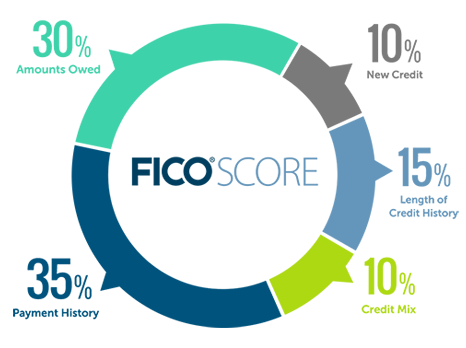

Your credit score is determined by five factors:

- Payment history (35%)

- How much debt you have (30%)

- How long you’ve had credit (15%)

- Your credit mix (10%)

- New credit, including new credit accounts and inquiries (10%)

Payment history accounts for 35% of your credit score. This is the biggest part of your credit score, meaning your payment history gets the most consideration in determining your credit score. If you’re trying to maintain or raise your score, make sure you always pay your lenders back by making on-time payments.

How a missed payment affects your credit score

When you miss even one payment, your credit score can go down. The more payments you miss, the worse for your credit.

Even worse, if you never pay a debt and it goes to collections, or if you file bankruptcy, your credit score will drop significantly, probably to the point of affecting your ability to get credit until you get your score back up again.

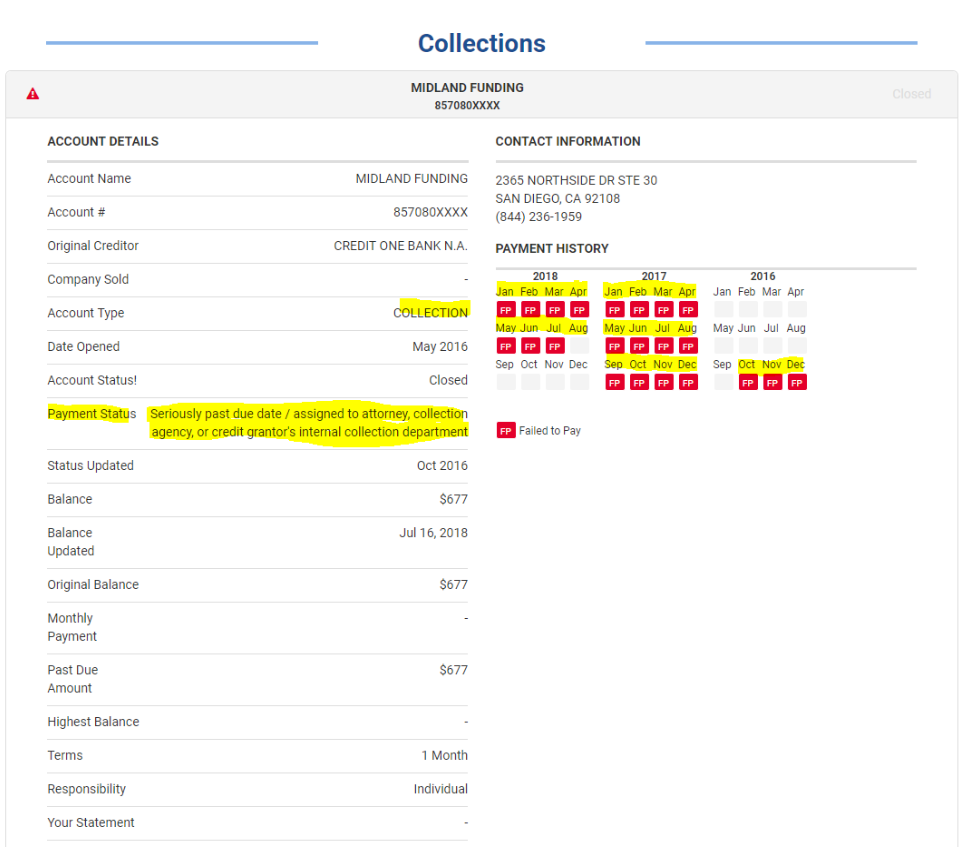

Midland Funding Collections

Getting a missed payment off your credit report

A missed or late payment stays on your credit report for seven years.

But the good news is that as time passes, missed or late payments become less damaging to your overall financial picture. In other words, if you missed some payments in the past but are now consistently making on-time payments, you will be a stronger loan candidate than if you have a current or recent late payment on your credit report.

So if you made a mistake or had financial trouble in the past, the more time that passes with you making on-time payments the more your credit score will rise and the better you’ll look to lenders.

Multiple credit cards

Having multiple credit cards might not increase your score but making on-time payments on multiple cards does have a stronger positive effect on your credit versus having only one card. The lenders will trust you more if they see you handle more than one account the right way.

That said, there are some strategies and reasons both for and against getting multiple credit cards.

Pro for having multiple cards: If you have only one card, and your credit utilization is high (using more than 30% of your available credit), your score will go down. So having several cards with low balances can help your score.

Con for getting multiple cards: Getting multiple credit cards all at once could lower your score because of all the hard inquiries that will go on your report every time you apply. Plus, lenders will wonder why you're suddenly applying for a lot of new credit.

Tip: If you want to get multiple cards, make sure you don't spend the maximum available on them. Also, if you aren't organized enough to keep track of multiple credit cards, either limit the number of cards you have, or pay all your cards on the same date to avoid missing a payment.

The takeaway here is that making your payments on time, whether with one or multiple cards, will boost your credit score.