In this Post:

- Understand the Impact of Credit Score Inquiries on your Report

- What are credit report inquiries?

- Your FICO Score and its Relationship with Hard Inquiries

- How long do hard inquiries stay on your credit report?

Understand the Impact of Credit Inquiries on your Report

A credit inquiry happen every time a company requests your credit score or your credit report from one of the big three credit reporting bureaus (Experian, Equifax, and TransUnion). For example, if you apply for a car loan, they will “pull” your credit. This is considered an inquiry. If you apply for a credit card, mortgage, or personal loan, the same thing occurs. Sometimes, even utilities or insurance companies will “pull your credit”.

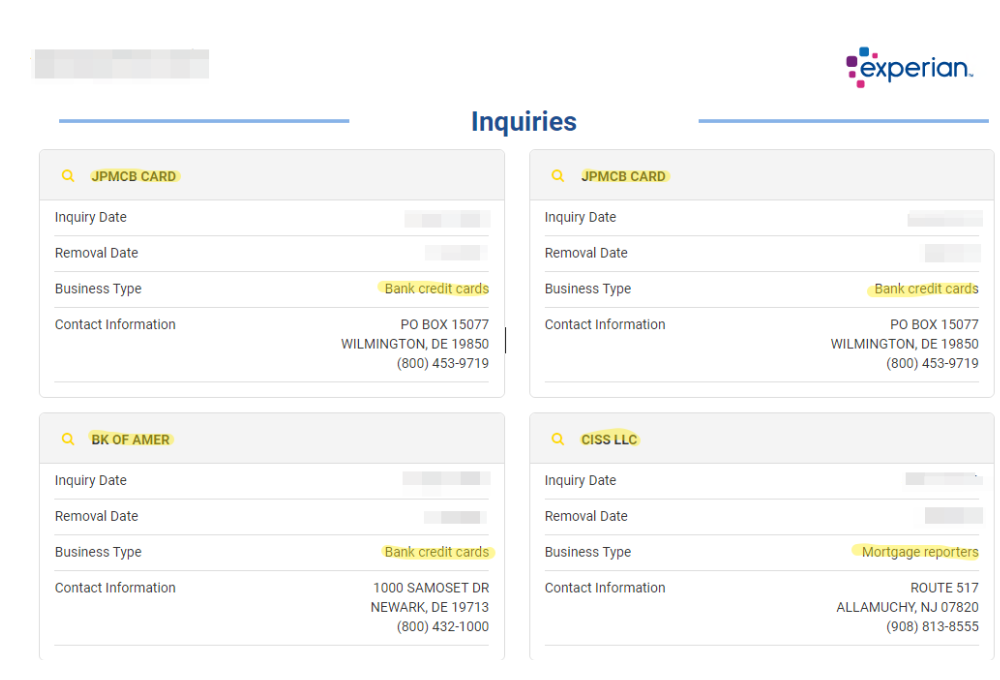

Applications for credit cards and a mortgage are both inquiries which affect credit score, and are noted on this credit report.

These inquiries can have a significant impact on your credit score.

But how much of an impact do they have? And do all inquiries have a significant impact on your credit score? Let’s go over a few important topics so that you can get the ins and outs of credit inquiries.

What are credit report inquiries?

A credit inquiry is just that: When someone formally inquires about your score or credit report. Why do they do this? To judge your credit worthiness. It shows up on your credit report under a heading called “inquiries.” So when anyone in the future “pulls” your credit report to judge your credit worthiness, they will see it listed.

While an inquiry itself is not inherently bad – it doesn’t mean you did anything wrong – too many can damage your credit score (we’ll explain why below)

It is important to understand that there are two basic types of inquiries: soft and hard.

The difference between a hard and soft credit inquiry is:

A“hard” inquiry would be when someone pulls your report with your permission, because you applied for credit or something else (like insurance or security clearance). This gets listed on your report, as described above — by impacting your credit.

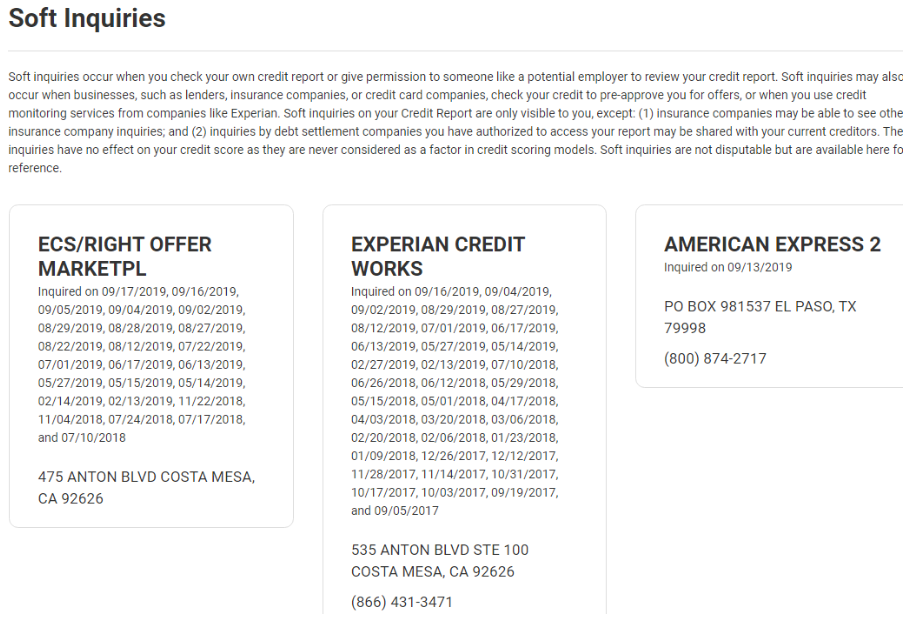

On the other hand, a soft inquiry is a bit different in that it may be listed on your report but will NOT impact your score (though your permission should be requested, regardless).

Soft inquiries are visible on this report, but they don’t affect credit score.

Soft inquiries are often pulled by a creditor that you already have, such as your current mortgage company or a bank whose credit card you already have in your wallet. They may request an updated credit score without your explicit approval (perhaps because they are considering offering you an increased credit line, or as part of a routine check to ensure your credit is still as good as it was when you got their card).

All those “pre-approval” offers you get in the mail will probably arrive in your mailbox after a soft inquiry was pulled on your credit line. Often, credit companies will buy your name and address from other creditors or get them from other departments in their own organization, then pull a soft report to decide whether to send you a “pre-approved offer”. Where, like we said before, a hard inquiry is one that you authorized by specifically applying for credit.

Your FICO Score and its Relationship with Hard Inquiries

Your credit score is often called a FICO score. FICO means “Fair Isaac Corporation”, which refers to the largest company that has a formula for calculating credit scores. It is the score most commonly requested by mortgage companies, car companies, credit cards, insurance companies and others when they want to judge your credit worthiness.

The reason your credit report is impacted by a hard inquiry is because the inquiry is actually printed in the credit report that a company pulls. Points are deducted from your FICO score for hard inquiries. Here’s what the means: points are added to your FICO for good things, like paying a bill on time. Then, points are deducted for bad things, such as missing a payment or having a hard inquiry.

Now, the big question remains of how large the impact on credit score a hard inquiry is. How many points on your credit score go up or down based on your history of credit pulls?

This can be a difficult question to answer accurately because the formula used by Fair Isaac, a data analytics company that owns the “formula” to calculate credit scores, is a somewhat guarded one. They rarely say exactly how many points will be gained or lost with certain credit activities. And this FICO score is given along with the credit report when it is pulled by any of the major three credit companies: Experian, Trans Union, or Equifax.

However, on their MyFICO website they do say that for many people a hard inquiry will cause the credit score to go down about 5 points. However, this is not a hard and firm number – different things can impact the points lost. And remember, it's not a free-for-all five points: Too many inquiries can result in many points lost. If you’ve ever wondered about the question of whether multiple inquiries affect your credit score, the answer is yes: The issue is cumulative.

For example, if you apply for three credit cards, that can theoretically (and easily) drop your score from say 705 to 690, that might put you in a totally different category in the eyes of future creditors.

So now you know HOW credit inquiries can have an impact but you might be wondering about WHY hard credit inquiries lower your credit score. The answer is that when you apply for credit you are showing, theoretically, that you NEED credit.

Crazy, right? But the fact is that if you look needy, that’s a bad thing.The amount of hard inquiries (one for each account you recently opened) will affect your credit score because of the hard inquiries pulled. If you are suddenly applying for five credit cards, it looks suspicious, and it looks bad both as a list item on your report and in the damage it does to your score.

As an aside, the age of your accounts factors into your score. While older accounts in good standing serve you well, brand new accounts can reduce your score. This is because new accounts do not demonstrate reliability because they are too new to show credit history, and also because they imply that you need credit and are out there applying for it. Also, if you have too much credit, either in the form of debt or even simply open credit lines from one or a combination of multiple cards, it can negatively impact your score and it doesn’t look good to creditors. Why? Because they worry you might use that credit and get into too much debt. Keep in mind that new credit makes up about 10% of your FICO score.

One important factor you’ll want to know about hard credit inquiries is that if you are applying for a major loan such as a home mortgage, auto loan, or student loan you are NOT penalized with a decrease in credit for shopping around, if it is all within a short period of time. You can have multiple such inquiries within a 30-day period and it will not cumulatively impact your score. Points are only deducted for a single inquiry in a specific loan category.

How long do hard inquiries stay on your credit report?

Hard and soft inquiries remain listed on your credit report for two years. HOWEVER, hard inquiries only impact your credit score for 12 months. This means that after 12 months the inquiry will come off your report, and the points will be added back to your score.

The only way to get credit inquiries removed from your credit report, other than to wait for them to fall off after two years, is to dispute them as unapproved. If you believe you have erroneous hard inquiries on your report, you should file a dispute with the individual credit reporting company (Experian, Equifax, or Trans Union).

Requesting your own credit report is totally okay, and does not put an inquiry on your report, nor does it impact your score. In fact, you can get one free credit report each year and it is a good practice to check your report every year or so. One way to request your report is to go directly to one of the big three: (Experian, Equifax, or Trans Union)

Raising your score because it has been lowered by inquiries is the same as raising your score for any other reason. For the most part, time is your best friend and will heal many credit wounds. But you can also:

- Pay your bills on time

- Pay down your balances

- Only open new accounts when you really need to

- Keep your oldest accounts active and in good standing

This leads us into the topic of whether there is an optimal amount of time one should wait before opening new accounts (taking the effects of hard inquiries into account). The answer to that is yes. Only open new accounts as needed, and, when all other inquiries are at least 12 months old and will no longer impact your score.