In this Post:

- Late Payments on Utility Bills

- The Difference Between How Credit Card Companies And Utilities Report Missed Payments

- How Cell Phone Companies Handle Missed Payments

- When Your Accounts Goes To Collections, You Credit Gets Hurt Worse

- How Unpaid Medical Bills Affect Your Credit Score

- Removing Delinquent Bills From Your Credit History

- Rebuilding Your Credit After Late Fees or Defaults

- Consider A Secured Credit Card To Help Rebuild Your Credit

- When You Can’t Pay All Of Your Bills On Time

- Dealing With A Charge Off

If you don’t pay your credit card bills on time, it can hurt your credit score. What you may not know is that other than credit card bills, late payments on other bills may also impact your credit.

Here are three overriding things to remember regarding any late payments:

-

Credit card companies, utility companies, and medical providers routinely provide late payment information to credit agencies. If you are delinquent for 30 days past your bill’s due date, that information will likely make it into your credit report.

Many companies that extend credit may not be required to report late payments to credit bureaus, but that doesn’t mean they won’t report you for paying late.

-

If your bill goes into default and it goes to a collection agency, it will show up on your credit card as a black mark that may take a long time to fix.

No matter what happens, you still owe the money. That’s not going away. The best advice is to always pay on time. If that’s not possible, though, there will be repercussions when it comes to your credit.

It’s not just credit card payments that can affect your credit score. Utility bills, phone bills, cable bills, and other bills all play a role in your credit score. The impact will vary depending on the type of account, who you owe, and how long you have been a customer. Late payments usually get reported to credit bureaus. The more you have, the bigger the impact on your credit score. Lower scores limit your ability to get credit or may cause lenders to insist on higher interest rates because of the increased risk.

A late payment (delinquency report) stays on your credit report for approximately seven years from the date it was past due.

Late Payments on Utility Bills

Any time you fail to pay a bill on time, you run the risk of late fees, termination of service, higher interest rates, and damage to your credit report. Utility bills are no exception.

Credit card companies report past due payments once payments go 30 days beyond the due date. There are no hard and fast rules on whether utility companies will report your missed payments to credit bureaus or when they will shut off your service. Utility companies are not required to report missed payments. Some do report them and some do not.

Before service gets shut off, they will send you a written notice. It may come in the mail or they may tack it on your door. Either way, most utility companies will provide notice of any impending shut-off at least a week before it happens.

If your service does get turned off, it will be reported to the credit bureaus. You credit score will drop. If you want to get service back on, you will likely have to pay a service startup fee and make a hefty deposit because you are a credit risk. If you move, the default will impact your ability to get water and electrical service at the new location. The utility company may ask for more money up front to protect their interests.

The Difference Between How Credit Card Companies And Utilities Report Missed Payments

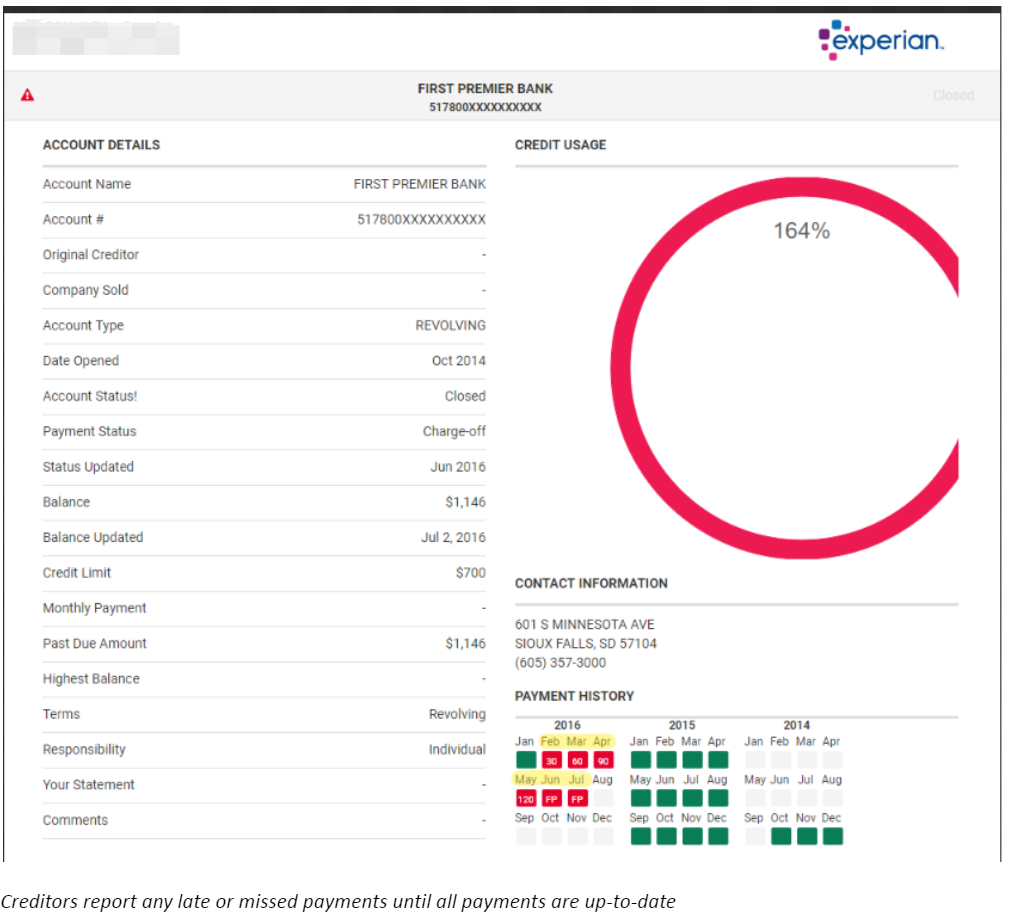

There’s a difference between the way late payments for credit card bills are treated and other bills, such as your water, electricity, or cable. Credit card companies will report your late payment to the credit reporting agencies if you are 30 days beyond the due date for payment. They will also report any late or missed payment every following month until you’re caught up.

These late payments will stay on your report for approximately seven years.

Utility, electricity, water, and phone are not required to report late payments. That doesn’t mean they won’t. Each entity has its own rules and they vary by location and municipality. While credit card companies will give you a grace period up to 21 days after the due date in which to make your payments, utility companies will not. If you miss the due date with a utility, it’s considered late and late fees will apply.

How Cell Phone Companies Handle Missed Payments

You may not think of cell phone companies as lenders, but they are advancing credit until you pay your bill at the end of each month. They will add late fees if you are late paying your bill beyond the due date and they typically do report missed payments to credit reporting agencies.

Whether they shut off your service depends on several factors, including your payment history, how long you’ve been a customer, and the specific company you are using. If you miss two payments, though, they will likely shut off your phone.

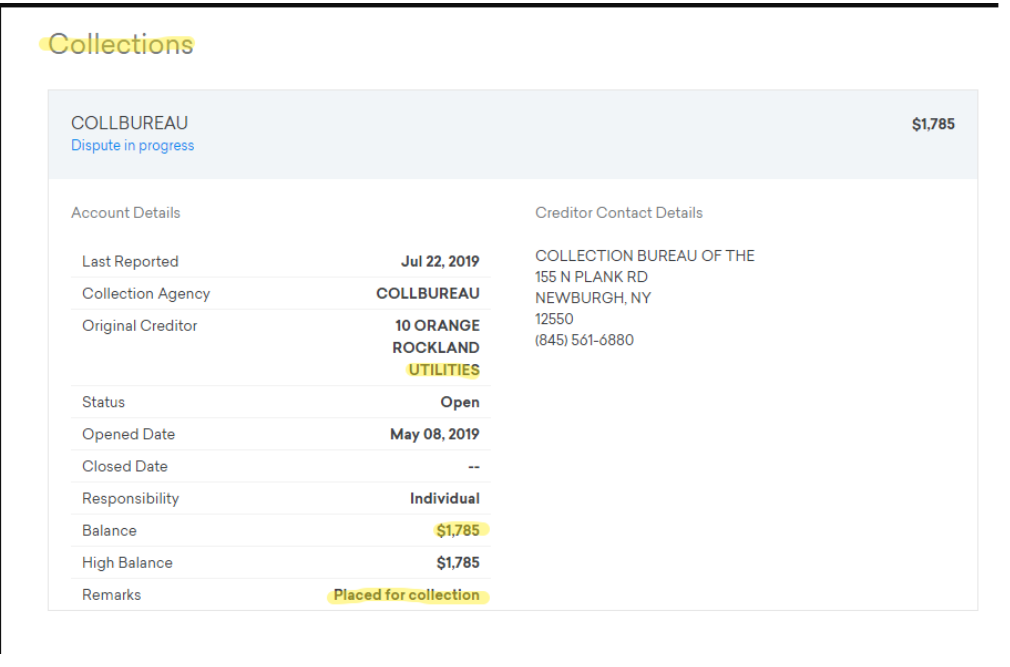

When Your Accounts Goes To Collections, You Credit Gets Hurt Worse

If you fall too far behind payments on most other bills like your phone or utilities, your account can land at collections. This happens when you owe money and the lender decides they no longer want to deal with trying to collect the money themselves. They may outsource collections to a collection agency or sell off your debt to a third-party company that will try to collect. When this happens, it’s bad news. The company you owe and/or the collections agency will report the default to the credit reporting agencies. While a late payment will have a moderate effect on your credit score, a collection agency report can have a major impact.

Unpaid utility bills sent to collection agency is reported to 3 large credit bureaus. This causes significant credit drop.

Even if the utility, water, and phone providers don’t report anything about your payment history to credit bureaus, bill collectors likely will. Failing to pay them on time can hurt your credit a lot.

How Unpaid Medical Bills Affect Your Credit Score

Your medical billing history is not part of your credit score. However, unpaid or past due medical bills can impact your score. If left unpaid, the amount owed may be sent to a collection agency. Hospitals and other medical service providers also bundle and sell off unpaid debt to third-parties. These third-party companies will buy the debt at a discounted price and then try to collect what you owe directly from you. If that happens, it will be reported to the credit bureau. It will be treated as a default on your debt and have a significant impact.

Most medical service providers do not report late or unpaid bills to the credit bureaus. If you can pay off the debt in a reasonable amount of time, or set up a payment schedule with them, you can usually avoid having your debt go to collections. Once it does go to collections or gets sold off, however, it will get reported by the collections company.

Credit reporting agencies typically will not show medical collections on their report until they are 60 days past due.

Removing Delinquent Bills From Your Credit History

If there is a delinquent bill on your credit report and it is inaccurate, you can ask the credit reporting agency to remove it. They will contact the company that reported the late payments to request verification. If they do not respond in a timely manner or admit the error, the delinquent bill will be removed.

If the late fee is accurate, you have fewer options. Your best approach is to contact the company reporting the late payment and ask them to remove it. A so-called “Goodwill Letter” explaining the reason behind the late payment, a pledge not to do it again, and a history of on-time payments may help convince them to remove the report. However, they are under no obligation to do so.

Delinquency reports stay on your credit report and impact your credit score for seven years. The more recent it is, the bigger impact it will have.

Rebuilding Your Credit After Late Fees or Defaults

Late payments, missed payments, and collections, remain on your credit reports for seven years. So will judgments. Most debt is unsecured. That means it’s not backed up by assets. A judgment on behalf of a creditor by a court means they can take physical assets to get their money back. This could mean garnishing your wages, freeze your bank account, or even sell off your physical assets.

Timely payments can make up as much as a third of your credit score, so it’s important that you work on clearing up the balances owed as quickly as possible.

Consider A Secured Credit Card To Help Rebuild Your Credit

If you know that you have difficulties paying on time, a secured credit card may be work for you. You pay a deposit up front, and your card is charged to the account where the money is paid. That means you will never miss a payment since payments won’t be authorized unless you have the money to pay it already in the account. It works much the same way as a debit card does. However, it is treated as credit and can be reported as such to demonstrate you are using credit responsibly. When getting a secured card, make sure the secured card issuer reports your card usage to credit reporting bureaus as this will build your credit by showing bills are being paid as they occur.

When You Can’t Pay All Of Your Bills On Time

If you find yourself unable to pay all of your bills on time, pay the essentials bills off first. You need a place to live, food to eat, light and heat to function well, and so on. Pay off what you need in order to live and work first.

If you have a mortgage, you might get hit with costly late fees, but the foreclosure process takes several months so skipping a payment if you are desperate won’t leave you without a roof over your head. Of course we do recommend being delinquent on your mortgage payments, no running water or electricity might be a more pressing problem. Just remember, though, that the late payment history will negatively affect your credit score.

If you do have to miss a payment to anyone, call each of the companies and ask for an extension. Often you make arrangements up front and get companies to defer payments, give you more time to pay, reduce late fees, or hold off on reporting to credit bureaus. If you show a genuine effort to pay your debts responsibly, they may work with you. You may want to offer a partial payment as a sign of good faith.

Dealing With A Charge Off

When a creditor decides you aren’t going to pay them and it’s too much effort to try to collect, they will give up trying to collect and write off the debt as a loss.

If an account is charged off, the balance owed is no longer on the company’s books as an asset. They claim it as bad debt for tax purposes. If they do, however, a charge off can really hurt your credit score. It can be one of the most damaging things to have on your credit report.

You should do whatever you can to avoid getting into this situation. Even if you pay off the bill, the charge off will remain on your credit report for seven years.

Not all utility companies report these charge-offs. Companies, at their discretion, may give you a so-called goodwill adjustment and agree to withdraw delinquency reports. They are under no obligation to do so, however. You can write a letter to the lender and plead your case. You may want to engage a professional credit repair company.