In this Post:

- New Credit Is a Credit Score Factor

- New Credit Can Hurt Credit

- Temporary Drop in Credit Score

- New Credit and Timing

- Managing Your Credit Cards

- New Lines of Credit

- Bottom Line

Whether you’re just starting your credit journey or you’re a long-time credit user, there is a lot of confusion around “new credit.” Is it good to open more lines of credit? Does new credit hurt your credit score? We’re going to breakdown just how new credit impacts you and your credit score.

The Impact of New Credit on Your Credit Score

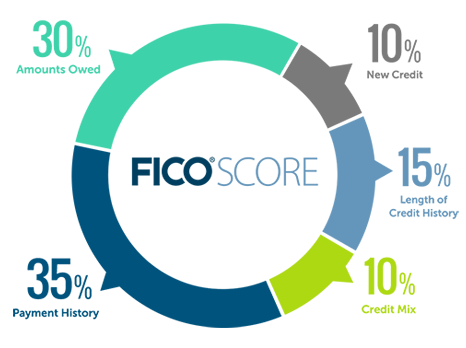

There are five factors that make up your FICO credit score. Out of those five factors, new credit makes up the smallest portion, which is 10%. So while new credit does have an impact on your credit score, it’s less significant than say, your repayment history (which is 35%).

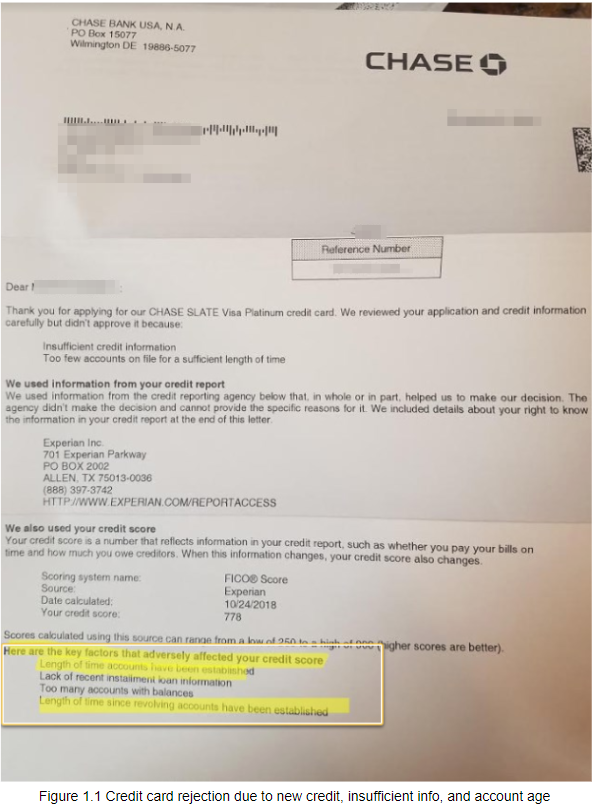

When getting new credit, your length of credit history and utilization will also be impacted, which will affect your credit score. Below in Figure 1.1, you can see that this consumer was rejected for a credit card due to too few accounts. Even getting new credit, the length of time the accounts have been established isn’t sufficient yet to make an impact.

What to Consider Before Applying for New Credit Cards

Does new credit hurt credit?

Yes and no.

Applying for new credit can result in a hard inquiry to check your credit and could potentially drop your credit score slightly. The drop is typically only a few points. However, if you apply for a lot of new credit in a short period of time that could be a red flag for lenders.

Because applying for new credit can drop your score, you want to evaluate the likelihood of approval before applying. So if you have average credit, you probably don’t want to apply for the top-tier rewards credit card that wants consumers with excellent credit.

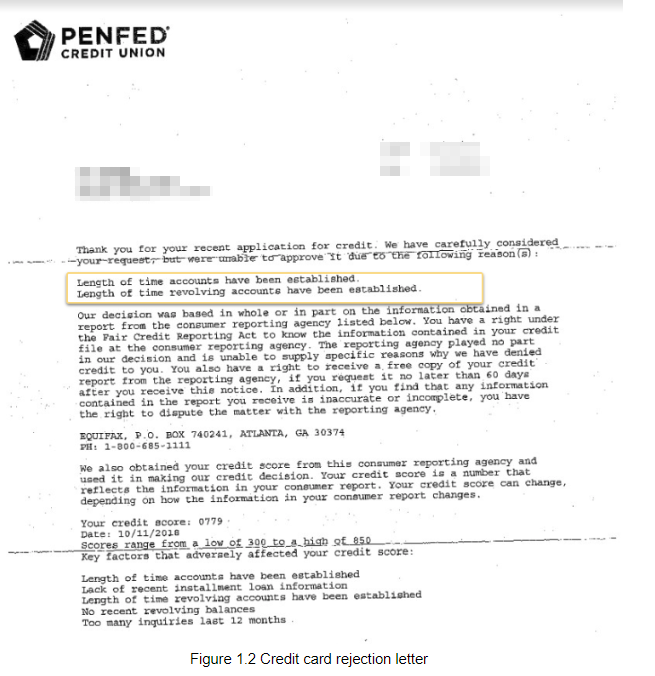

As you can see below in Figure 1.2, this consumer was rejected for a credit card in part due to the new credit and age of account. Additionally, the letter says their credit score was adversely affected due to too many inquiries in the past year.

New credit and age of accounts go hand in hand. As a consumer, you should be mindful of how many new credit inquiries you have within a year.

Here’s Why You May See a Temporary Drop in Your Credit Score After Getting a Credit Card

If you applied for a credit card and get a notification that your credit score dropped, you might be perplexed.

Huh, what happened?

You might think “Why did my credit score drop after getting a credit card?” It doesn’t seem to make sense.

When you apply for a new credit card, the lender is evaluating your creditworthiness and how much of a risk you are. The hard inquiry can result in a drop in your credit score, but it’s not significant or long lasting, if you play your cards (pun intended) right. Just how many points does your credit score go down when applying for a credit card?

In general, your score can drop five to 10 points, according to FICO.

According to credit bureau Experian, “A single inquiry is not likely to have a substantial effect on scores, but you might see a slight drop temporarily, especially if you have had multiple inquiries recently. In most cases, scores tend to rebound within a few months, assuming everything else in the credit history is in good shape. Generally speaking, new accounts come with new risk. If you are approved for the account, you may also notice a dip in scores when the account first appears in your credit report. However, if you keep your balances low and make all your payments on time, your scores should rebound.”

So while the drop in score may be concerning at first, it should recover in a couple of months so long as you are responsible with your credit and repay on time and keep balances low.

Why Timing Is Everything When Applying for New Credit

So if you apply for a lot of new credit in a short period of time you probably want to know if too many credit cards hurt your credit. Well, if you apply for a lot within a short time frame this can look like you are dependent on credit and potentially a risky borrower.

In the lender’s eyes, this could pose a threat to your creditworthiness. So it’s not necessarily having too many credit cards, but if you open too many credit cards or lines of credit within a couple of months.

After all, lenders want borrowers who can pay them back. If you keep opening lines of credit, it can look like you need it, and that the likelihood of you paying back the loan is low.

How Many Credit Cards Should I Have?

If you’re a credit card lover or have a decent amount of credit cards you may be wondering, “Just how many is too many credit cards?” Well, there’s not an exact science or number that everyone should follow. What it comes down to is how you manage the credit cards and your overall credit utilization.

If you have six credit cards that are all maxed out, that might be too many. If you have six credit cards, pay on time 100% of the time, and keep your credit utilization below 30%, the impact can be positive.

What is “too many” is when all of the new credit starts getting into debt territory and becomes unmanageable. If you’re unsure, start slowly with just one or two credit cards.

Also, you want to have a strategy if you’re opening up so many credit cards. Is it for the rewards? If so, can you meet the spending minimums, and will you end up using the miles and cash back?

Remember, credit cards are a tool for your finances, not something to play around with.

For How Long Is New Credit Considered “New”?

New credit refers to opening new lines of credit. But how long are they considered “new”? Typically about one year. According to the site myFICO, “Inquiries remain on your credit report for two years, although FICO® Scores only consider inquiries from the last 12 months.”

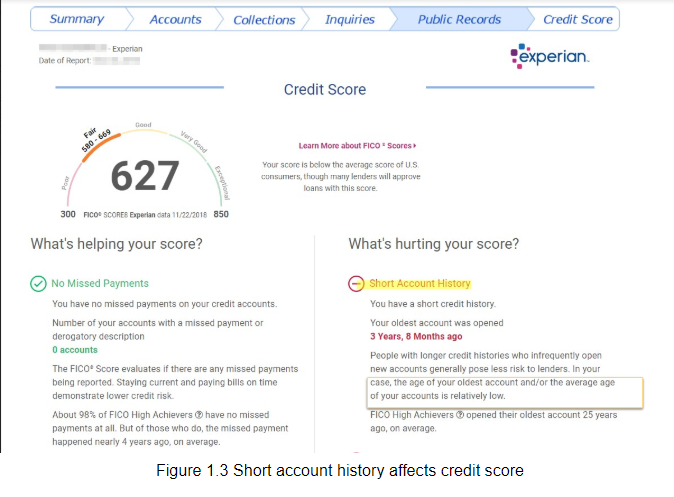

As you can see in Figure 1.3, this consumer’s credit score is affected by the short account history. The good news is that after a year’s time, your accounts won’t be considered new and should positively help your length of credit history if you keep the account open.

Bottom Line

If you’re ready to open a new credit card or apply for a loan, know that new credit won’t have a huge impact on your credit score overall. If you’re currently dealing with a dropped score because of a new credit line, know that it’s likely temporary.

Be careful with credit — take on only what you need and make payments on time. Doing so will help you stay on the right track with credit.