In this Post:

- All You Need to Know About a Credit Freeze

- Reasons to Freeze Your Credit

- How to Freeze a Credit Report

- Good News! Getting a Credit Freeze Is Free

- Freezing and Unfreezing Credit: How Long Does Each Take?

- How to Unfreeze a Credit Report

- Does a Credit Freeze Affect Existing Credit Lines?

- Conclusions

Have you ever dealt with a credit line opened in your name — but it wasn’t you?

Have you ever felt like people were accessing your personal information on your credit report?

Unfortunately, this kind of stuff happens all the time. In today’s world, fraud and identity theft occur at an alarming rate. What can you do to protect yourself and your information? When managing credit, one thing to do is to get a credit freeze.

Read on to learn what a credit freeze is and how to get one.

All You Need to Know About a Credit Freeze

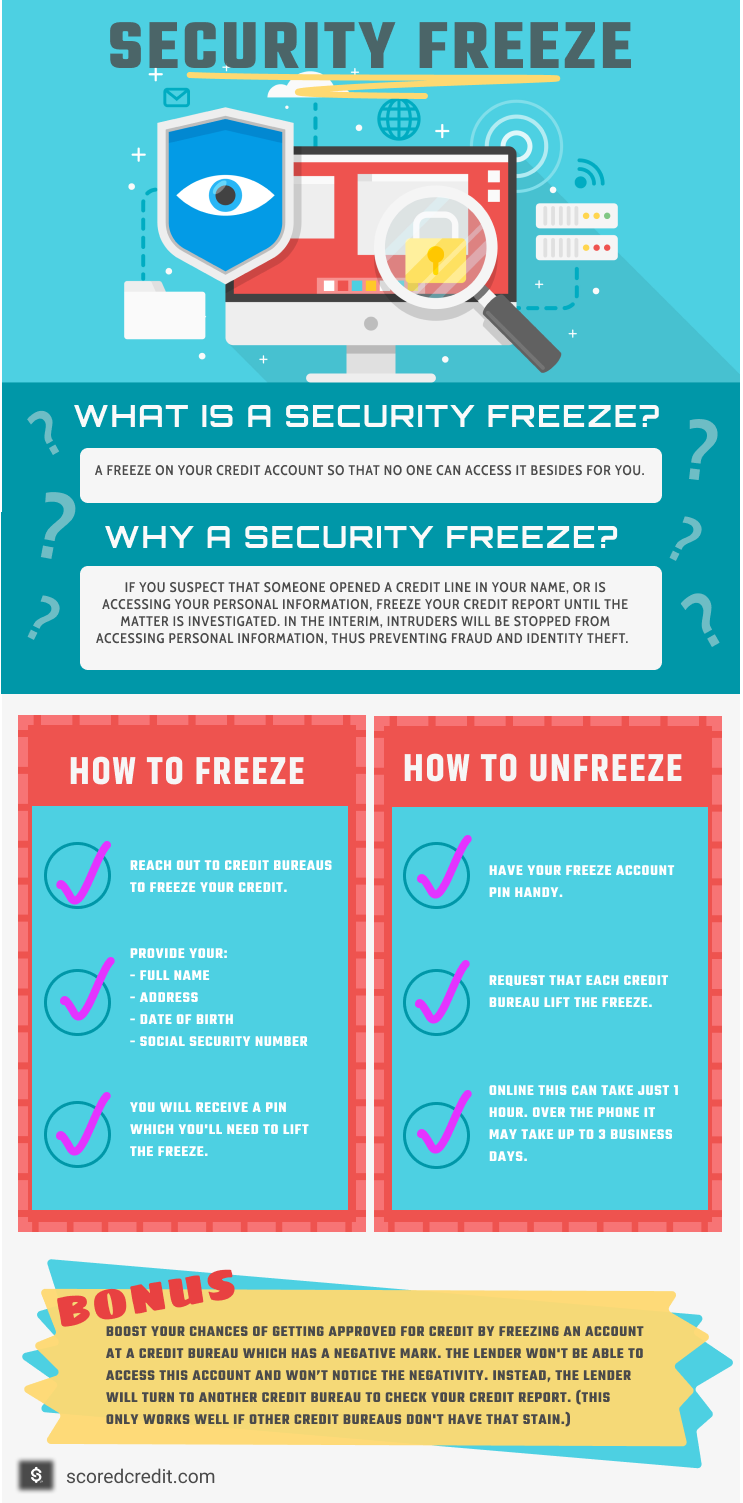

A credit report freeze commonly referred to as a security freeze, is just what it sounds like. It’s putting a freeze on your credit, so that no one can access it aside from the account holder. The account holder receives a personal identification number (PIN) and can only lift the freeze with that number.

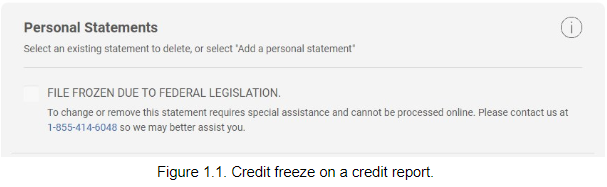

Credit freezes can be helpful to stop and prevent any further instances of fraud and identity theft. The freeze essentially stops any intruders from accessing your personal information, so you can keep your info safe. Below, you can see what it can look like when you have a freeze on your credit report.

Reasons to Freeze Your Credit

If you’re dealing with identity theft or fraud, getting a credit freeze can make sense. You want to put a halt to any outsiders who may have access to your information. If you want to be proactive, you can also initiate a freeze on your credit report.

It’s important to note that getting a security freeze is different than having a fraud alert on your account. According to the FTC, “A credit freeze locks down your credit. A fraud alert allows creditors to get a copy of your credit report as long as they take steps to verify your identity.

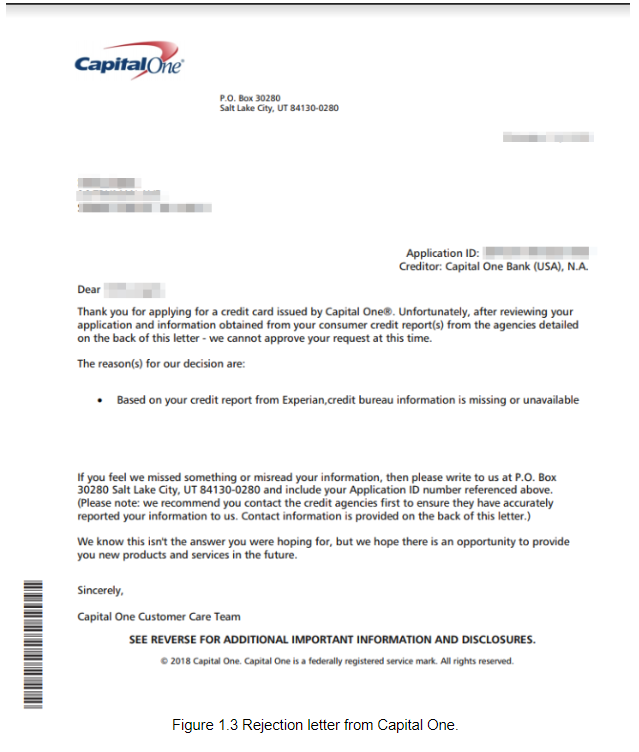

Another interesting thing that we found is that a credit freeze could potentially boost your chances of getting approved for credit. If you know which bureau the bank will pull from, and there’s a negative mark on that account, you can put a freeze and they will likely have to go through another credit bureau. Of course this all depends on what information each credit bureau has.

As you can see in the letter below, this consumer was rejected by Capital One based on info from Experian, as this account was frozen. Instead, this consumer can request that Capital One pull a report from a different credit bureau.

How to Freeze a Credit Report

The good news is that thanks to the Economic Growth, Regulatory Relief, and Consumer Protection Act you can put a security freeze on your credit report for absolutely free. This was passed recently to offer more protections and security measures to consumers.

If you want to act on your credit report, you might wonder how do you put a freeze on your credit reports? What is the best way to freeze your credit report?

While the process is fairly easy, you do need to be thorough. You will need to put a security freeze on your credit reports at all three credit bureaus.

The three credit bureaus are TransUnion, Equifax, and Experian.

888-909-8872

TransUnion LLC

P.O. Box 2000

Chester, Pennsylvania 19022-2000

800-685-1111

Equifax Security Freeze

P.O. Box 105788

Atlanta, Georgia 30348

888-EXPERIAN (888-397-3742)

Experian Security Freeze

P.O. Box 9554

Allen, Texas 75013

In order to put a freeze on your credit, you will need to provide your personal information to each credit bureau:

- Full name

- Address

- Date of birth

- Social Security Number

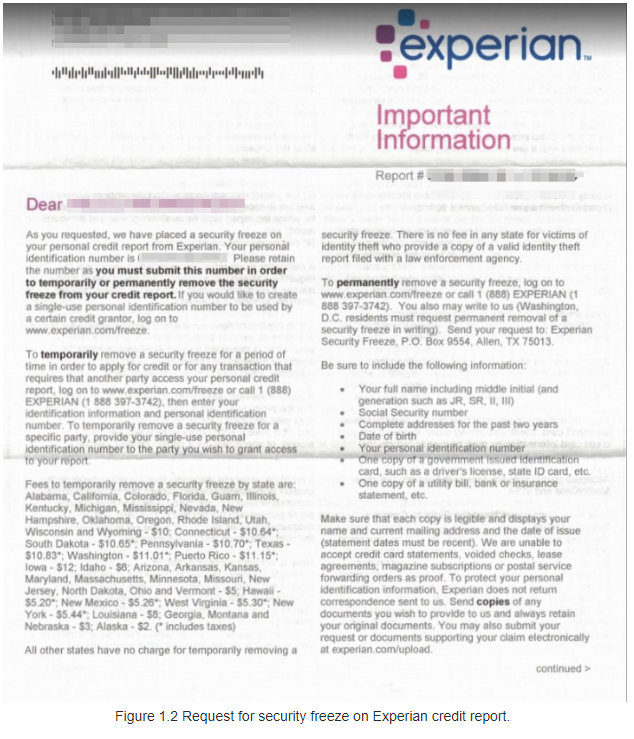

Once you put in the request, you’ll get a unique PIN from each credit bureau. Of course you will want to keep these three PINs somewhere safe as you will need them when you want to lift the freeze. As illustrated below, you can see an example of a security freeze letter from Experian, which includes the PIN.

Good News! Getting a Credit Freeze Is Free

Remember that you can put a credit freeze on your accounts at any time for free. If there is an agency or organization trying to charge, run. You can go directly to the credit bureaus and do all of this for free.

Freezing and Unfreezing Credit: How Long Does Each Take?

Placing the credit freeze only takes a few minutes. When you put a freeze on your credit, it doesn’t take very long to go into effect — it could take at least one business day.

But how long does it take to thaw a credit report? When it comes time to unfreeze your credit — which is sometimes referred to as “thawing” your credit report — depends on how you make the request. If you do it online, the freeze will be lifted within the hour. If you do it over the phone, it could take up to three business days.

How to Unfreeze a Credit Report

OK, you know how to freeze your credit report but you’re probably curious about how to unfreeze a credit report. “How do I lift a security freeze?”

You’ll have to get in touch with all three credit bureaus. You can do this online or over the phone and you will need your PIN for each of the bureaus. Here’s additional info for taking next steps to unfreeze your credit report:

How do I lift a security freeze with Equifax?

Sign up to myEquifax account. A PIN is no longer needed for online freezing or unfreezing.

800-685-1111

How do I get a freeze lifted from my Experian credit report?

https://www.experian.com/freeze/center.html

855-414-6048

How do I lift a security freeze with TransUnion?

https://www.transunion.com/credit-freeze

888-909-8872

Does a Credit Freeze Affect Existing Credit Lines?

A credit freeze will not affect your existing credit lines. Some people will still be able to access some information, including

- You! You can still view your credit report

- Current creditors looking to review your account

- Rental agencies for background check

- Utility company

- Debt collection agencies

- Child support agencies

- Prescreening for any credit offers

So as you can see, a credit freeze will prevent someone from accessing your credit report and information, but your current creditors and several other entities will still be able to access the information they need.

Conclusions

Whether you’re trying to fight identity theft or just want to be proactive, getting a security freeze on your credit report can help protect your information. Just be sure to contact all of the credit bureaus and know there are some limitations in some states. Kentucky, Nebraska, Pennsylvania, and South Dakota remove a credit freeze after seven years. Other states? It’s indefinite. Just be aware of all these time limits and stay on top of managing credit with each of the credit bureaus.