In this Post:

- Take Control of Your Finances with Balance Transfer Credit Cards

- First, what is a balance transfer?

- The Benefits of a Balance Transfer

- Qualifying for a Balance Transfer Card

- How Do Balance Transfers Affect My Credit Score?

- Choosing the Best Balance Transfer Credit Card

- How Do I Do a Balance Transfer?

- Don’t Forget the Fine Print

- Multiple Balance Transfers

- Points and Rewards on Balance Transfer Credit Cards

- Bottom line

Take Control of Your Finances with Balance Transfer Credit Cards

You’ve probably heard about balance transfer credit cards.

Maybe it was from a friend who used one to consolidate his debt. Or from a sibling who cleared off a credit card with an outrageous APR.

Credit card balance transfers are a popular and effective way to manage debt.

But they’re not magic. Getting the wrong card or not commiting to a strong payment plan can leave you worse off than you were before.

Here are the facts you need to do a balance transfer right.

First, what is a balance transfer?

The simplest version of a credit card balance transfer is transferring debt from one credit card to another credit card with a lower interest rate.

Two years ago, Credit Card A hooked you with a low introductory APR rate and you used the credit card to pay for home improvements, hoping to pay off the loan before the promotion period ended.

But you ran out of luck. The regular APR of 17% kicked in, and you have a balance of $2,000. And you want out.

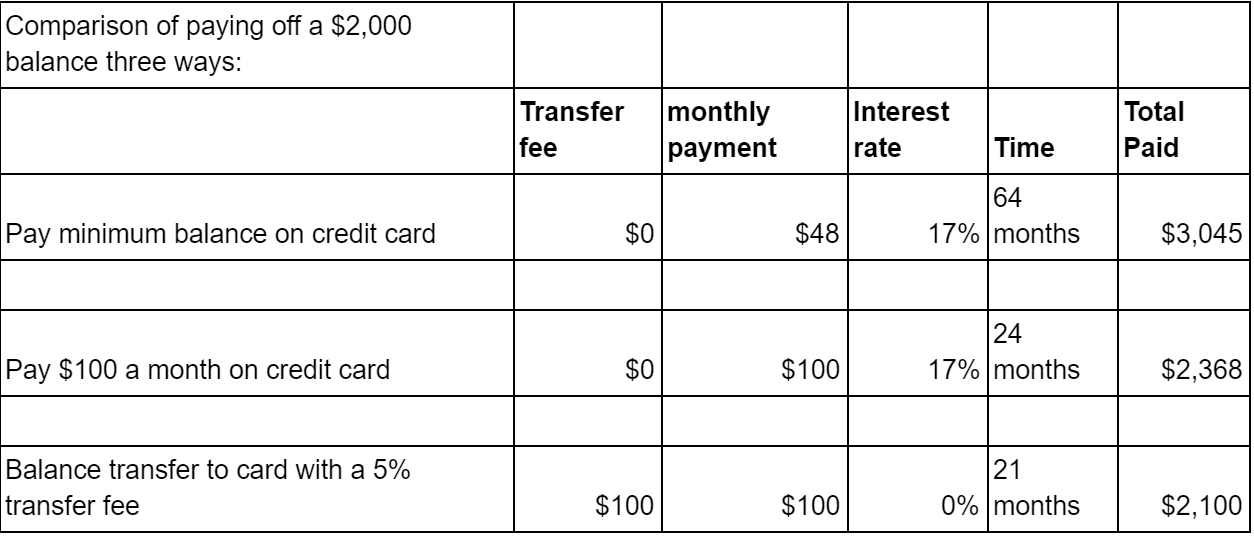

Here’s where a balance transfer comes in. You apply for Balance Transfer Credit Card B. For a transfer fee, the lenders of Card B pay off Card A. Now you owe $2,000 plus the transfer fee to Card B instead of Card A. The transfer fee is a percentage of the total balance that you transferred, and ranges from 0% to 5%.

The advantage is that Card B is offering you an introductory 21-month balance transfer APR of 0%. That means you have nearly two years to pay off the money without any interest.

Here’s a look at the money you can save:

The Benefits of a Balance Transfer

You can see how a balance transfer can be a lifeline, saving you time and money:

- Balance transfer cards offer a low promo APR for anywhere from 6 months to 21 months.

- Besides saving you money, the low APR can also cut the time it takes to pay down the debt because your entire payment goes towards the principal.

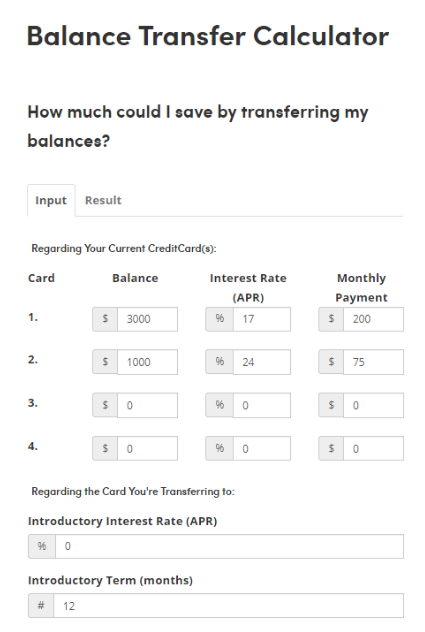

- You can transfer multiple balances onto your new balance transfer credit card, up to your new credit limit. You’ll organize your debts into one, easy to track monthly payment. And you’ll be less likely to incur late fees from missed payments.

- It’s possible to pay off non-credit card debts, too. You can request a balance transfer check. That’s a blank check which you can use to pay down a car loan or other liability with the same terms as a balance transfer. Some cards will even let you use it as a cash advance. Using the checks can be tricky though, so be sure you read all the fine print.

A balance transfer credit card can save you time and money when paying off a debt.

Balance transfer cards are regular credit cards that can also be used for daily purchases, but be careful. The promo APR may not apply to those charges. You can find yourself with a confusing dual-interest-rate balance on that card. The balance transfer will keep its 0% rate, but your other charges can be subject to a 17% or higher APR.

Qualifying for a Balance Transfer Card

Unfortunately, the best balance transfer offers may be reserved for people with excellent credit. Still, as long as your credit score is good, you should qualify for a decent card.

How Do Balance Transfers Affect My Credit Score?

Credit scores themselves are so complex that there’s no simple answer to that question. A balance transfer can help in some ways and hurt in others.

Any new credit card decreases your score temporarily. A balance transfer credit card is no exception.

.

On the other hand, your credit utilization ratio can improve. That’s the ratio of your monthly balance to your total credit line — and you want it to be low. Adding another line of credit on your new card can help lower that score.

Keep in mind that closing a credit card hurts your score. You should keep the cleared credit card open unless it’s too tempting for you to run up a debt on it again

Even with all those factors, the most important element of your credit score is making payments on-time. If the balance transfer will help with that, it’s worth it, despite the small dings.

Choosing the Best Balance Transfer Credit Card

There are lots and lots of options in transfer cards out there, and your goal is to make the best financial decision.

Don’t get sidetracked by rewards or points, although we’ll take a look at those a little later.

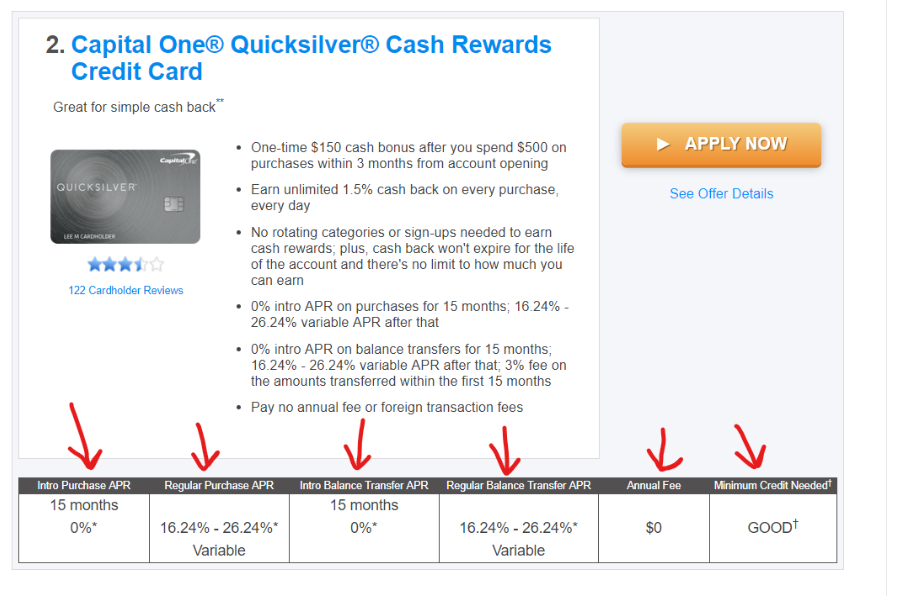

The most important numbers to consider are:

- The balance transfer fee

- The length of the introductory 0% APR

- The regular APR after the intro expires

- The amount of money you owe

Insider Tip: A 0% balance transfer fee can save you more money than a longer promo 0% APR period. Use a balance transfer calculator to crunch the numbers and see for yourself.

The interplay of those factors is incredibly complicated. You can compare the numbers with a balance transfer calculator to be sure you make the best choice.

How Do I Do a Balance Transfer?

It’s easy.

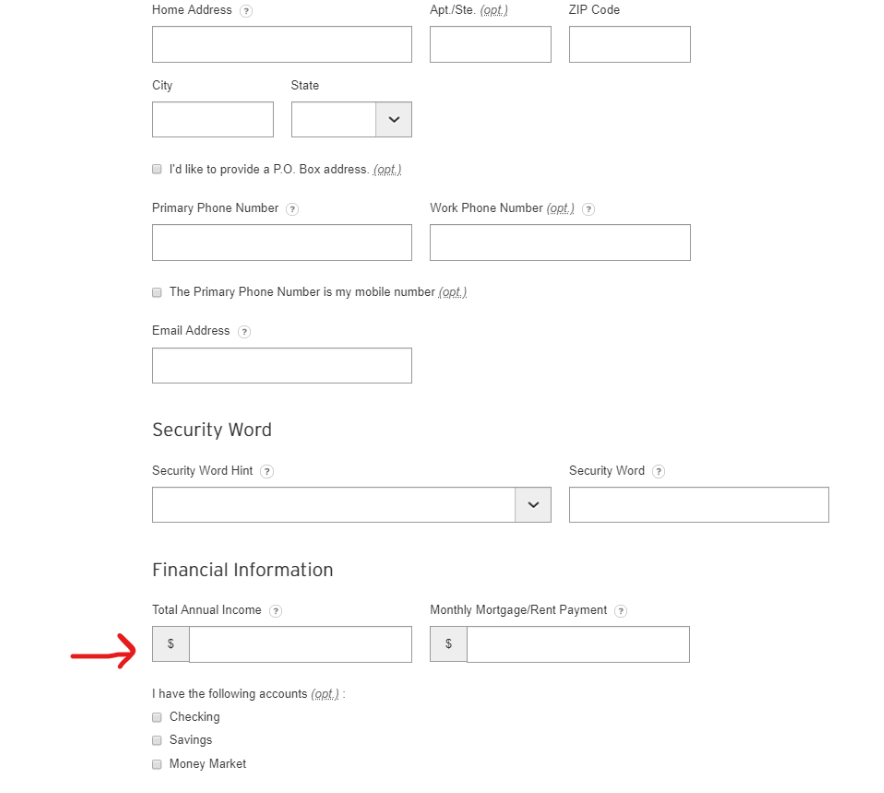

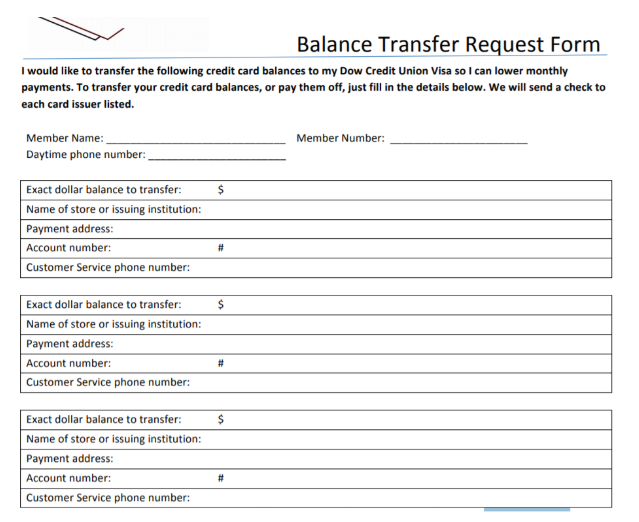

Once you have your card, you can arrange the balance transfer by phone or online. You’ll need to indicate:

- Which credit card or other lender to pay

- The account numbers

- How much you want to transfer

That part takes minutes.

The actual transfer can take up to two weeks while the balance transfer credit card company contacts your creditors and pays them the money you owe. It’s essential to be aware of this transfer time. If you have any payments due during this period, you’ll still need to pay them until the balance transfer payment appears as a credit on those account statements.

Insider Tip: Follow up with a phone call if your balance transfer takes longer than 14 days to post to your account.

Don’t Forget the Fine Print

Balance transfer cards offer great value, but they have rules and limitations. Here are a few to ask before you commit:

- What is the balance transfer fee? It can range from 0 - 5%, depending on the card. The Chase Slate Card is a popular 0% option. Bank of America Americard and Amex Everyday sometimes also offer 0% transfer fees.

- Does the transfer fee count towards your credit limit?

- Can you transfer the maximum amount of your credit limit? Some cards, like American Express, won’t allow the full amount.

- How long will it take for the balance transfer to go through?

- Is there a time limit for making a balance transfer at the promo rate? On many cards, transfers must be done within 45 days to get a 0% APR.

- For how many months does the 0% APR last?

- What is the APR rate for regular purchases and for after the promo expires?

- What happens if you make a late payment? For many cards, you will immediately lose your 0% APR.

- Does the balance transfer card have an annual fee? If it does, stay away. That cost will probably outweigh any benefit you would get from the balance transfer.

- Do any of your existing credit cards allow balance transfers? They will sometimes offer promotional APRs.

Every card is different, so you’ll need to get the details clear from the card you choose.

Multiple Balance Transfers

I know what you’re thinking. You can get the best of all worlds using this trick: Apply for a balance transfer card with a 0% transfer fee even if the promo period is short. When the promo APR is about to expire, get a second balance transfer credit card and move over the balance.

Will it work?

Technically, yes. You can keep on doing balance transfers indefinitely until the balance is paid. But is it a smart long-term debt payoff plan?

Based on data from the Federal Reserve, more than ⅓ of Americans carry credit card debt.

Maybe not, and here’s why:

In the current market, there’s a seemingly unlimited supply of 0% APR offers. But what if the market changes and cards cut back? It’s happened before, and it could happen again. You’ll be left holding the bag with a high APR and no transfer possible.

Plus, opening a lot of new cards impacts your credit score. What if you can no longer get approval for a balance transfer card with favorable terms?

You’re taking a risk and relying on a lot of unknowns to make multiple balance transfers your strategy. But if you’re faced with a pressing situation, there’s no reason not to try to get another card.

Points and Rewards on Balance Transfer Credit Cards

Can you earn points and rewards when transferring your balance? That depends.

Most cards don’t give points for the balance transfer itself since it’s not a payment. There are exceptions, though. If rewards are a priority for you, check out Barclays, who occasionally offers rewards on balance transfers.

But is it worth it? Often not. Cards that offer top rewards can come with annual fees, high balance transfer fees, and short promo periods. You may get your perks, but come out behind in the long run.

Insider tip: Credit cards with top rewards programs are usually not the best choice as balance transfer credit cards.

Bottom line

When choosing your balance transfer credit card, keep your eye on the ball.

Your goal is to choose the card that will allow you to pay off your debt as quickly and cheaply as possible. Other perks may get in the way from your true goal and hurt your long-term financial standing.

Balance transfers can be the key to getting your finances back on track. Make sure to do it right.