In this Post:

- Preparing for an Auto Loan

- Types of Auto Loans

- Auto Loans and Your Credit Score

- Building Credit with Auto Loans

- Is It Worth Paying off Auto Loans Early?

- Key Auto Loan Points

You’re ready to get a new set of wheels and upgrade your car. You can’t wait to drive around with something new. Buying or leasing a car can be an exciting, and stressful, time. There’s a lot to think about and consider. Two things to think about: How auto loans affect your credit and what your credit score can afford you. Before buying or leasing a car, read on to learn what you need to know about auto loans, leases, and your credit.

Your Ultimate Auto Loan Checklist

When you’re ready to get a new ride, you want to have your funding in place to make it happen. Before you find funding, you’ll want to:

- Check your credit report at AnnualCreditReport.com to make sure there are no mistakes. If there are errors, you’ll want to dispute them with the credit bureaus.

- Make sure your credit is in good shape, so you can get the best rates available.

Our data has shown that you don’t have to have great credit to get approved for a car loan. As long as you have some credit history and are in good standing, you are likely to be approved.

- Get your finances in order and know just how much you can afford each month. What’s your budget? Your budget should determine what kind of car you can afford not the other way around.

Then you can apply for a car loan at a- bank

- credit union

- online

The lenders might put multiple inquiries (hard pulls) on your report which is usually a negative. However, you can apply for several funding options within a 14-day period and it will only show up as one inquiry on your credit report. So be sure to apply for car loans within a two-week period.

After getting the funding you need, it’s time to check out the options for your new ride. Be sure to check various dealers, compare prices, and see if you can negotiate.

Auto Loan Options for Those with Bad or No Credit

If you have good credit you’ll have no problem getting a car loan and securing a good rate. But what if you have bad credit? Or worse, no credit at all? What can you do when you know you need to buy a new car?

Here are options to consider:

- Get a co-signer. If you have no credit history, you’ll likely need a co-signer for your car loan. A co-signer is someone, like a parent or spouse, who is legally responsible for the loan as well. Their good credit can help you. Just be sure to make payments on time. If you don’t, your co-signer is on the hook for those payments!

- Put more money down. If you can put more money as a down payment for the car, you may improve your chances of getting a car loan.

- Find the right lender. You might see if there are lenders that specifically work with consumers with bad credit or no credit.

Typically, you must be at least 18 years old to get approved for a car loan.

The average credit score to buy a used car is 655 and 714 for a new car, according to an article on Bankrate.com. If you have a lower credit score than that, you may be approved for a car loan but have a much higher APR.

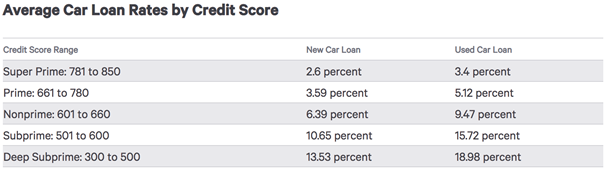

For example, if you have a subprime credit score which is between 501–600 you can expect to have an APR of 10.65% for a new car and 15.72% APR for a used car. Check out the chart below to see your prospective APR based on your credit.

Source: Bankrate.com

If you have bad credit, talk with your local bank that you have a good relationship with and see if they will work with you. You may also look at options online at RoadLoans.com.

Your Ultimate Auto Loan Checklist

Have you been eyeing your dream car for a long time? Need funding to make that dream a reality? You can totally make it happen, but before signing on for the car, make sure that your funding is in place. Here’s how to do it right.

How Auto Loans Can Affect Your Credit Score

When buying a car, you’re probably focused on getting the best rates and terms, but you also want to think about the long-term effect on your credit.

Do auto loans affect your credit? And if so, what should I do?

As we already know, having credit and using credit, builds credit.

However, in this case, a car loan or lease can boost your credit score, even more because that adds a credit mix to your credit score.

An auto loan will show up on your credit report as an installment account. If you already have a credit card, which is a revolving account, but no other installment accounts like a student loan on your credit report, your auto loan could help build your credit.

Why? A chunk of your credit score—10%—is determined by credit mix. In other words, the various accounts that are in your credit report can help you have a balanced portfolio.

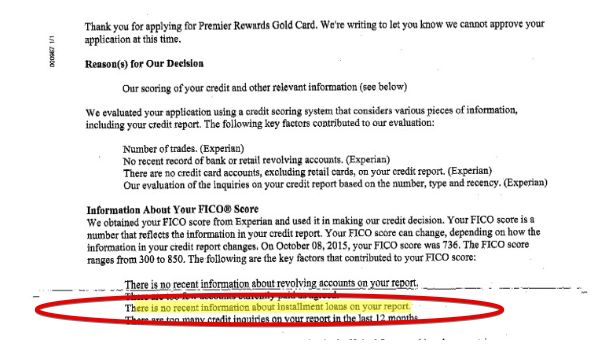

In our data below, you can see an example of a credit report where a consumer is turned down for a credit card because there is a lack of credit mix. They have no installment loan to report and got turned down. This is why a car loan can help as it is an installment loan and can add to your credit mix.

A consumer getting denied a credit card due to lack of credit mix.

Essentially, having various account types like installment loans and revolving credit can show a lender that you can handle different types of accounts. Getting an auto loan may help your credit mix, which, in effect, could help your credit score.

Win-win, right?

How to Use Auto Loans to Build Credit

While adding an auto loan to the mix can help your credit score, what matters the most is your PAYMENT HISTORY. So, if you take out an auto loan and pay it back on time every month, you can build your credit.

So, in short:

- auto loans can add to your credit mix

- a positive repayment history can help your credit score

When should I make my payments to maximize my credit score increase?

The best time to make payments on your auto loan to build your credit score is on or before the due date. Making your payments on time will help you boost your score.

How long will it take to improve my credit?

After getting approved for your car loan or lease, the impact it will have on your credit will depend firstly on what credit score you started out with. However, like everything about credit, your credit score will first drop due to

- the new inquiry

- the new account on it

- the new balance

- increase in utilization, etc.

After a few months of positive repayment, your score will increase to an even greater, better, and more solid score.

Getting an auto loan and making payments on time can help boost your credit score in as short as a month. In fact, a car loan or lease can boost your score 20–40 points after several months.

Depending on your score: If you already have a score above 800 with a good credit mixes, the increase will be lower than if this is your first loan and your score is in the 720 range.

The key is to be consistent with your payments and your score will build over time.

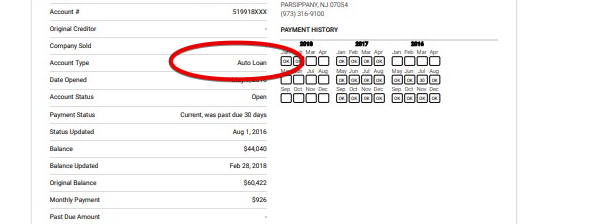

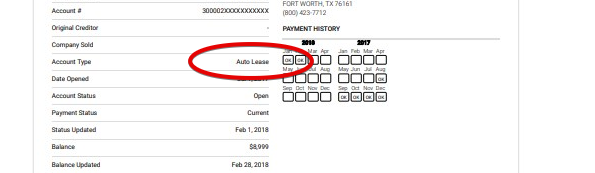

On your credit report, there will be a difference if you finance a car compared to leasing a car, however it won’t affect you adversely from a credit standpoint; see the example below.

Our data illustrates that it shows up differently on the credit report. Whether you finance or lease a car, as long as you stay in good standing your credit will build over time.

What Early Repayments of Auto Loans Mean for Your Credit Score

Interested in paying off car loans early?

You don’t want to be saddled with debt and if you can pay off your car loans early, why not?

You would think that paying off car loans early would help build your credit score. But, it’s a little more complicated than that. On one hand, if you have lots of other debt, this could help you lower your credit utilization. In other words, it can free up the amount of credit you use and boost your credit score.

However, paying off car loans early also mean a drop in your credit score.

What? That seems confusing and just wrong, right?

Well, it’s true.

You see, having your auto loan account active can increase your age of accounts and continue to add to your positive repayment history.

When you pay off auto loans early you are closing that account, which could lead to a drop in your credit score. According to some Credit Karma users, their credit score dropped anywhere between 2 points to 71 points. How much your credit score drops will depend on the rest of your credit report and payment history.

If you’re trying to build your credit with your auto loan, We would advise to keep the account open. Of course, you want to consider the cost of interest and what you’ll be paying over time. It may make more sense to pay off the auto loans early. Just understand how it can affect your credit score.

The Bottom Line

Whether you have great credit or no credit at all, there are ways that you can get an auto loan. When used in the right way, an auto loan can score you a new ride and also help build your credit.