In this Post:

- Missed Credit Card Payment

- Your Payment History and Credit Score

- Improving Your Payment History

- Your Payment and Credit History

- Late Payments and Your Credit Report

It can happen to anyone. Life gets busy and you forget to pay your credit card bill.Once you realize you’re late making a payment, you might start to panic. You wonder how payment history impacts your credit score and how long does payment history stay on your credit report?

Oops, I Missed a Credit Card Payment. What Now?

If you missed a payment, it’s important to make a payment and get in good standing with your account. But it may have a lasting effect on your credit score — at least for a while. Read on to learn more about how payment history impacts your credit score.

Why Payment History Is Key to Your Credit Score

Imagine that you want to bake a pie. What is the most important ingredient? Flour.

While the other ingredients are important, flour makes up the largest part and is the base of a pie.

When it comes to your credit score, your payment history is like flour in a pie. Out of all the factors that contribute to your credit score, your payment history has the biggest impact. As you can see below, your payment history has the biggest percentage of what determines your credit score:

The five factors that determine your credit score:

- Payment history — 35%

- Amounts owed — 30%

- Length of credit history — 15%

- New credit — 10%

- Credit mix — 10%

Lenders want to know that you can pay your bills on time and that your accounts are in good standing. So if you’re curious and wonder, “How long does payment history affect credit score?” the answer is, “Always!”

It’s the top contributor to your credit score.

How - and Why - to Improve Your Payment History

If you’ve missed a payment here and there you may worry — “How long does payment history stay on your credit report?” More importantly, you may be wondering “How do I improve my payment history on my credit report?”

These questions can plague you if you haven’t been on top of your payments. In order to improve your payment history, it’s crucial to make a payment and get in good standing.

The best way to improve your payment history is to continue to make your payments on time and in full. Consistency is key to improving your payment history.

If you’ve recently missed a payment there’s good news and bad news. The bad news is that your negative payment history may cause a lender to decline your application for credit. So if you’re looking to get approved for credit right now with a negative payment history, you may not have the best luck on getting approved.

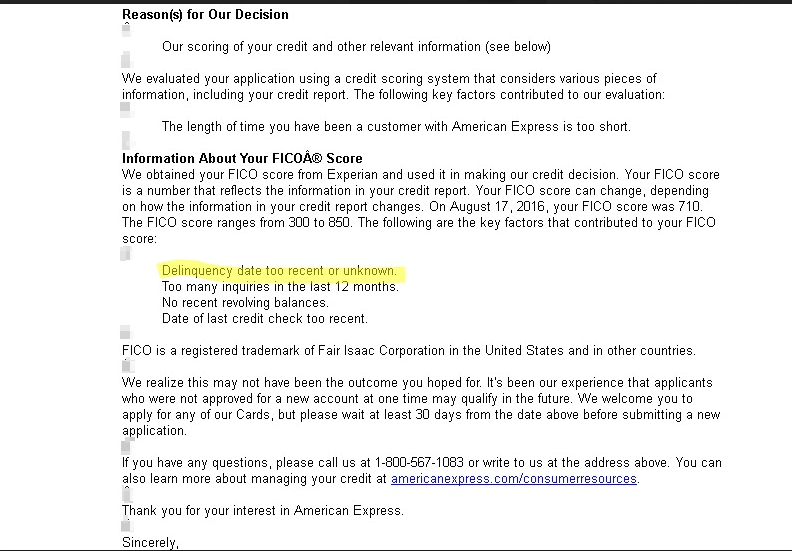

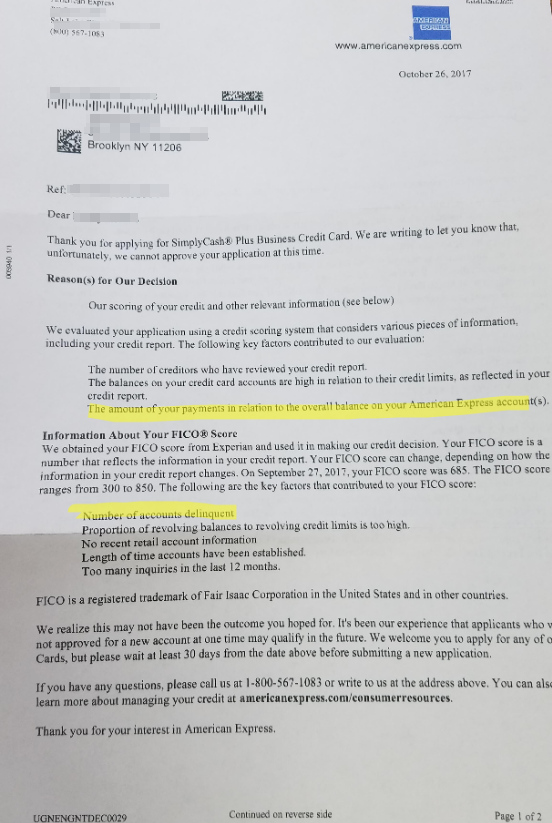

As you can see in the example below, getting declined because of a recent negative payment history is a possibility. So If you’ve missed a payment, it’s best to wait a while until applying for more credit.

Figure 1.1 Declined credit application due to recent negative payment history, among other reasons.

Figure 1.2 Letter declining credit application, with payment history as a factor.

The good news? Time is on your side when it comes to your credit. As time goes on, the impact of the missed payment will lessen. It is possible to get approved for additional credit after enough time.

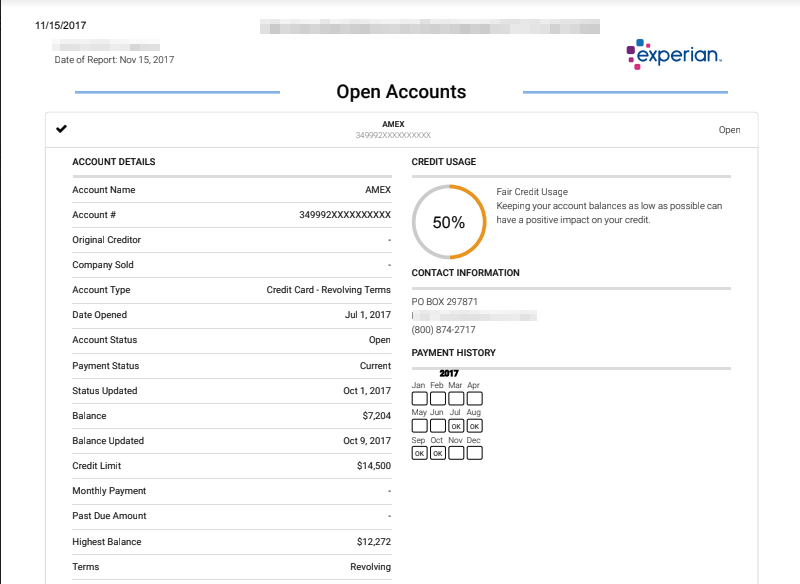

Figure 1.3 New credit account opened in 2017.

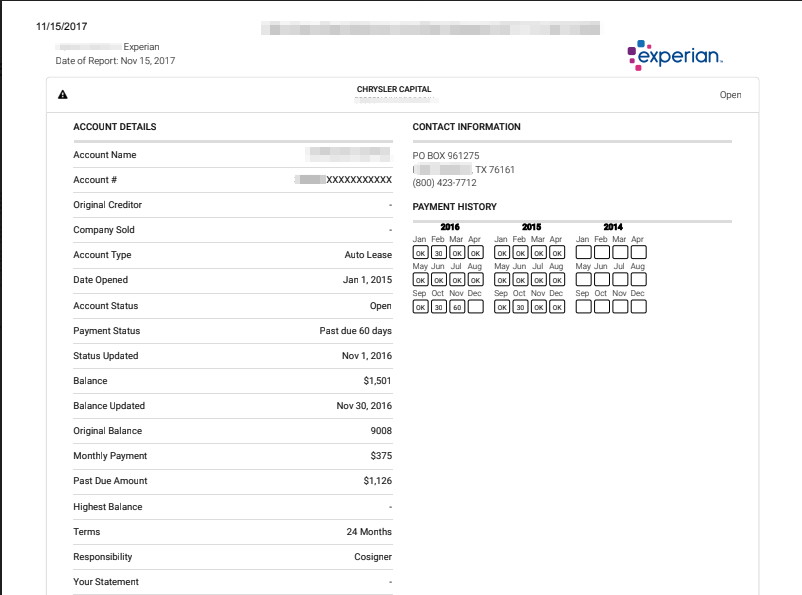

Figure 1.4 Account that is past due 60 days in 2016.

In our example above, a consumer was approved for new credit in 2017 after having an account that was past due for 60 days in 2016. In other words, missing a payment won’t hurt your ability to get credit forever.

Payment History and Credit Score Factors to Consider

Your credit score and payment history have a delicate and often confusing relationship. If you have a great credit history and your payment history has been consistent over the years, one or two missed payments won’t automatically be a credit score killer. On the other hand, having a spotless payment history won’t result in a “perfect score” either.

Missing a payment happens.

How your payment history impacts your credit score depends on a number of factors. FICO considers:

- How late your payment was

- The amount owed

- How recent the late payment occurred

- How many late payments there are

Late Payments? There Are Consequences to Your Credit Report

Missing a payment can be stressful. It can affect your payment history and you may be hit with late fees and have to pay additional interest. That’s what you have to deal with now.

But how will it affect your future? How long does payment history stay on your credit report?

Well, if you have a negative remark on your credit report for late payments, unfortunately, it will stay on your credit report for seven years. After that, the late payment will be removed.

While that is a long time, as noted above, as time passes, the impact of the late payment will lessen. You may be able to get approved for more credit if your account is in good standing and you make consistent payments on time.

The key to keeping your credit score in good shape is to stay on top of your payments. Pay your bills on time and in full and you’ll likely see an improvement in your credit score. If you make a mistake and miss a payment? There will be consequences but it’s not the end of the world. You can recover.