In this Post:

- The Meaning of Credit Mix

- Why Credit Mix Matters

- 3 Main Types of Credit

- Credit Score Factors

When it comes to your credit score, there are five main factors that make up your score. The most important one, that carries the most weight, is your payment history. Lenders want you to make payments on time, and it matters.

On the other end of the spectrum, one of the least important factors is your credit mix. Your credit mix makes up 10 percent of your score. While not the most important thing, it’s something to consider if you want to improve your score.

Read on to learn more about credit mix, why it’s important, and the various types of credit.

What You Need to Know About Credit Mix

Your credit mix refers to the different types of credit you have in your credit portfolio. When you take out a loan of any kind, there is a different classification for each type of loan. For example, a credit card is considered revolving credit. So when people talk about credit mix, they are referring to the diversity of accounts you have.

Why Your Credit Mix Matters to Lenders

Your credit mix is important because lenders want the confidence to know that you can handle multiple types of loans.

- Mortgage? Check.

- Credit card? Paid on time, always.

- Student loans. On auto-debit!

If you have various types of credit in your credit portfolio, it shows lenders that you can be responsible and manage different types of loans.

If you only have student loans, you’ll produce a credit score. But if you have student loans and a credit card, your credit score will likely be higher.

Why?

Because you have two different types of loans that you manage.

If you only have one type of credit, it’s a good start. Though having multiple accounts can be better.

Think of a banana, for example. It’s good on its own. But add it to banana bread, even better! Same thing with your credit. Just having one type of loan is good but having multiple types of loans will give you the ingredients you need for improved credit.

But remember, if you don’t absolutely need to open a new type of credit account, it’s probably not worth it — just focus on maintaining good spending and paying habits on whatever existing credit accounts you have. Your scores can still benefit from that.

A Closer Look at Different Types of Credit

If you want to improve your credit with credit mix, it’s important to know the types of credit that you can have. There are typically three types of credit.

- Revolving credit — think of a credit card. The amount of credit you have is revolving and changes month to month as you pay back the loan. If you pay in full (which you should do if you can!) then you’re back to square one and your full credit limit is available to you.

- Installment loans — an installment loan is a set amount for a loan that is paid back in installments over a period of time. Think of student loans, which you take out and may pay over a 10-year repayment period. Mortgages (which can also be “real estate” in your credit report) and auto loans are also considered installment loans.

- Open credit — a type of loan with no set repayment period or limit and can be used repeatedly. The most common form of this is a line of credit, like a HELOC (home equity lines of credit).

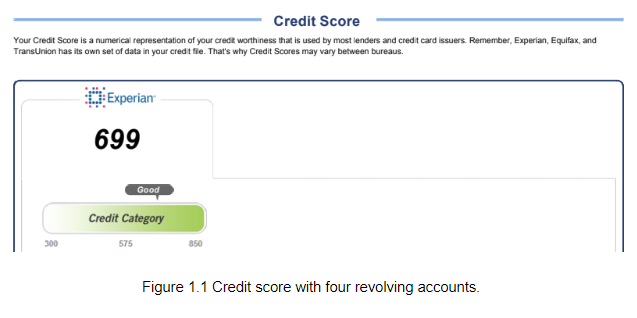

Having a mix of both of these can help your credit. Below in Figure 1.1 you can see a consumer’s credit score before taking out a mortgage. At this time, he only had four revolving accounts.

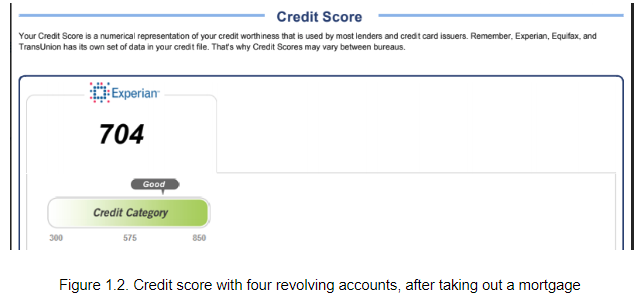

Above, in Figure 1.2, you can see a slight increase in his credit score by five points. Having a mix of various types of credit is advantageous for borrowers and attractive to lenders. If you’re a credit score junkie aiming for the highest score, having different types of credit mix is key.

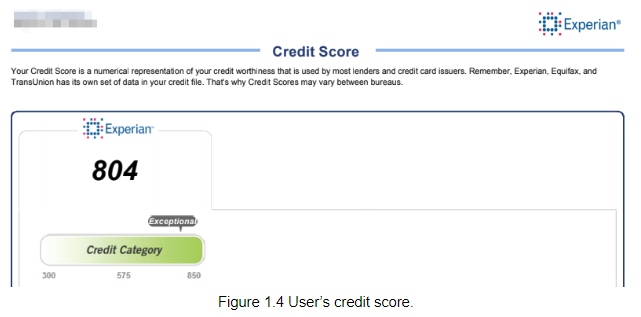

As you can see in Figure 1.3 the borrower has a diverse credit portfolio.

As you can see he has several accounts and a lot of account variety. These factors prove him to be a responsible lender with a credit score that surpasses the 800 mark — out of a total of 850.

Given these two examples, you can see that even a perfect repayment history and being in good standing on your loans won’t get you perfect credit without a credit mix. If you want to strive for the 800s, you must have a credit mix with various types of accounts. We can see that the report above has many different types of accounts — a healthy credit mix — which gets him an 804 credit score.

Credit Score Factors to Remember

If you want to have the best of the best credit score, then having various types of credit is important. Though it only makes up 10 percent of your score, it could boost your score to have a mix of revolving and installment accounts. That’s not to say just open an account and borrow money you don’t need — but if you borrow responsibly having various types of loans can be a good thing.