In this Post:

- A Beginner’s Guide

- Three Types of Credits

- Three Types of Cards

- Why would someone get a charge card?

- Is a charge card good for building credit?

- Who offers charge cards and credit cards?

- The Bottom Line

A Beginner’s Guide To Credit Cards, Charge Cards, and Debit Cards

Charge cards. Debit cards. Credit cards. You’ve heard all of these terms tossed around, but what do they all mean? Many people use these terms interchangeably, but they’re actually quite different from one another.

Below we’ll explore the differences between credit cards, debit cards, and charge cards, so that you can confidently decide which card type is best for you.

Let’s dive in.

Three Types of Credits

Before we talk about different types of cards, it's important to understand the different types of credit. The three types of credit are: revolving, installment, and open credit. Let’s talk about the pros and cons of each.

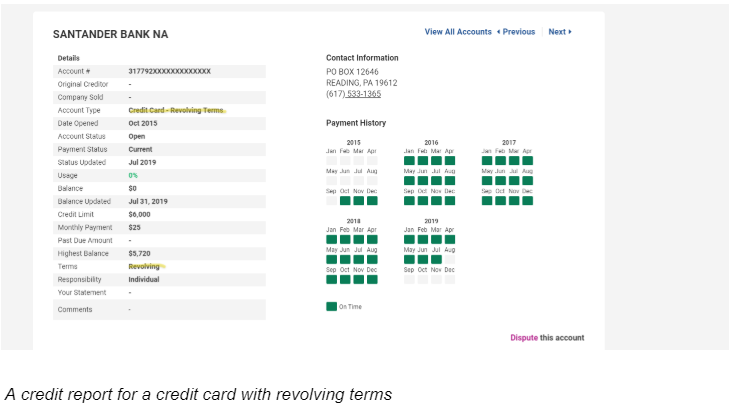

1. Revolving credit

Revolving credit is most often associated with credit cards. You’re able to spend the line of credit as you wish, up to a certain amount. If you can’t pay the balance in full, you’ll accrue interest on the rollover amount.

Pros: Funds are available when you need them and you don’t have to pay it back right away

Cons: Have high interest rates and lower credit limits than traditional loans

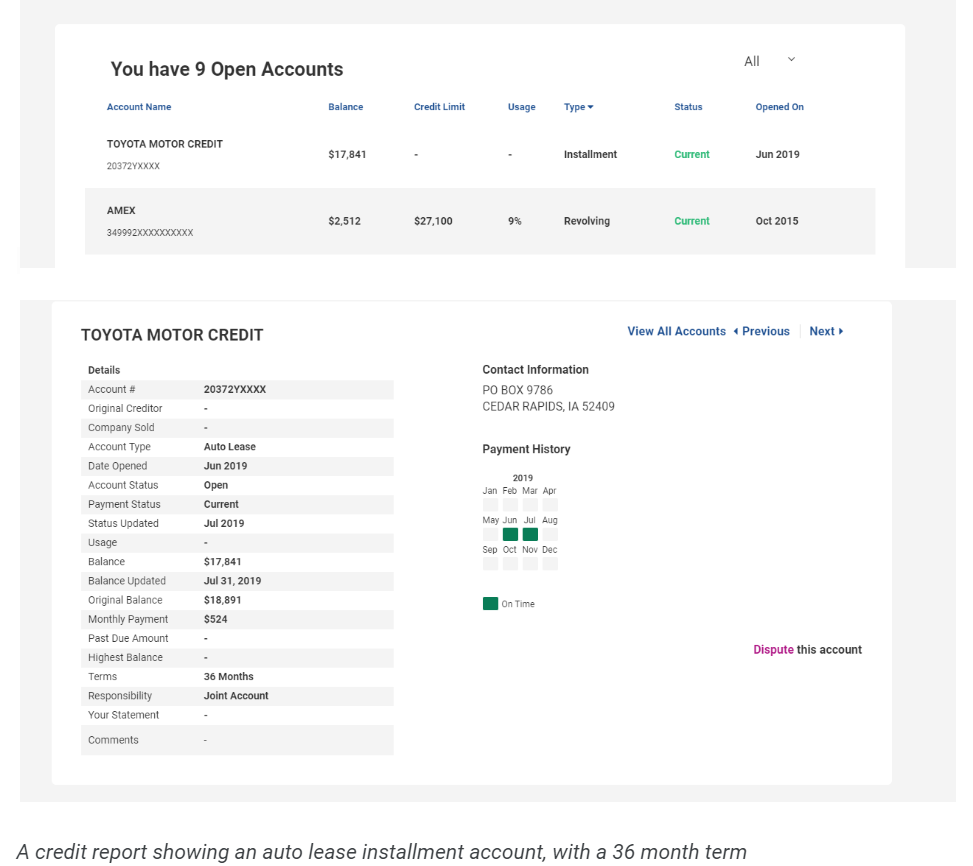

2. Installment credit

As the name implies, installment credit is credit that you pay back in regular, recurring payments. This type of credit include mortgages, student loans, auto loans, and personal loans.

Pros: you know exactly how much you’ll pay every month and the line of credit is higher than with revolving credit

Cons: these loans typically cost more in interest the longer it takes to pay them off

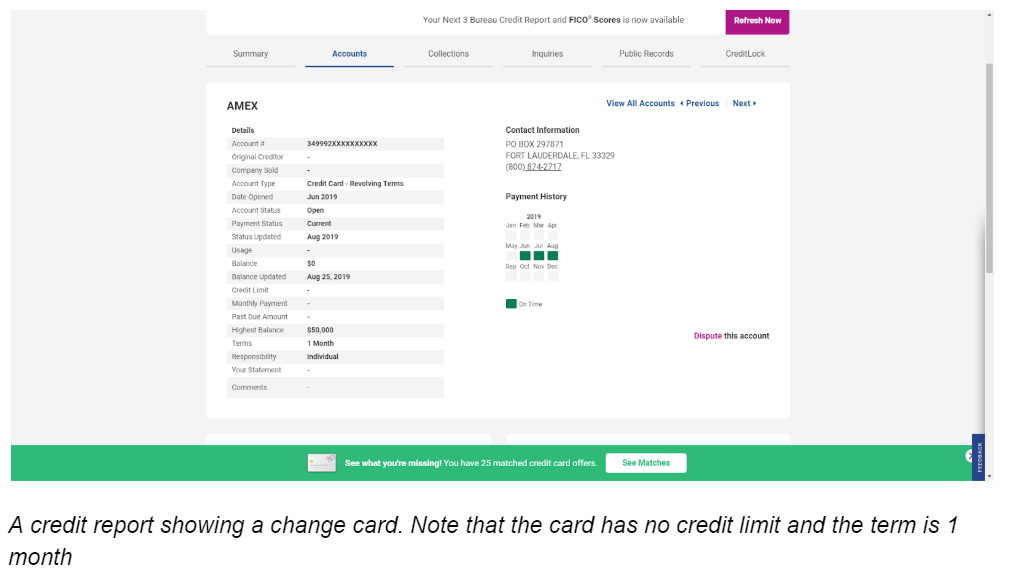

3. Open credit

Open credit—the least popular of the three types of credit—is most often associated with charge cards.

Pros: no credit limit, can't go into debt, and builds credit

Cons: must pay balance in full each month, may have large annual fees, and not as widely available as revolving and installment credit

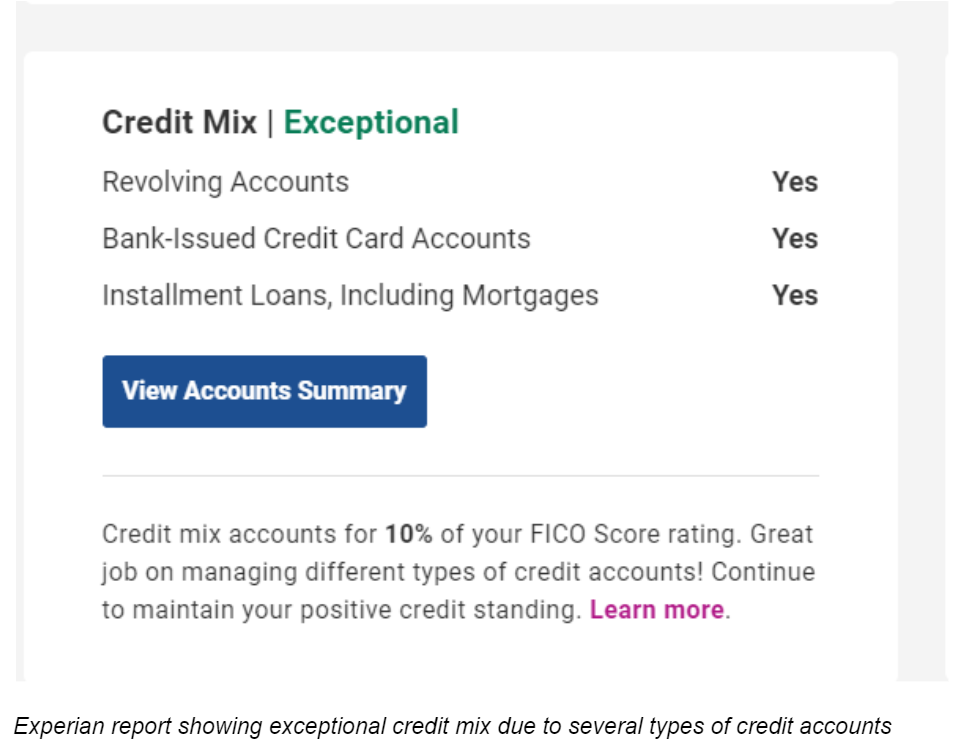

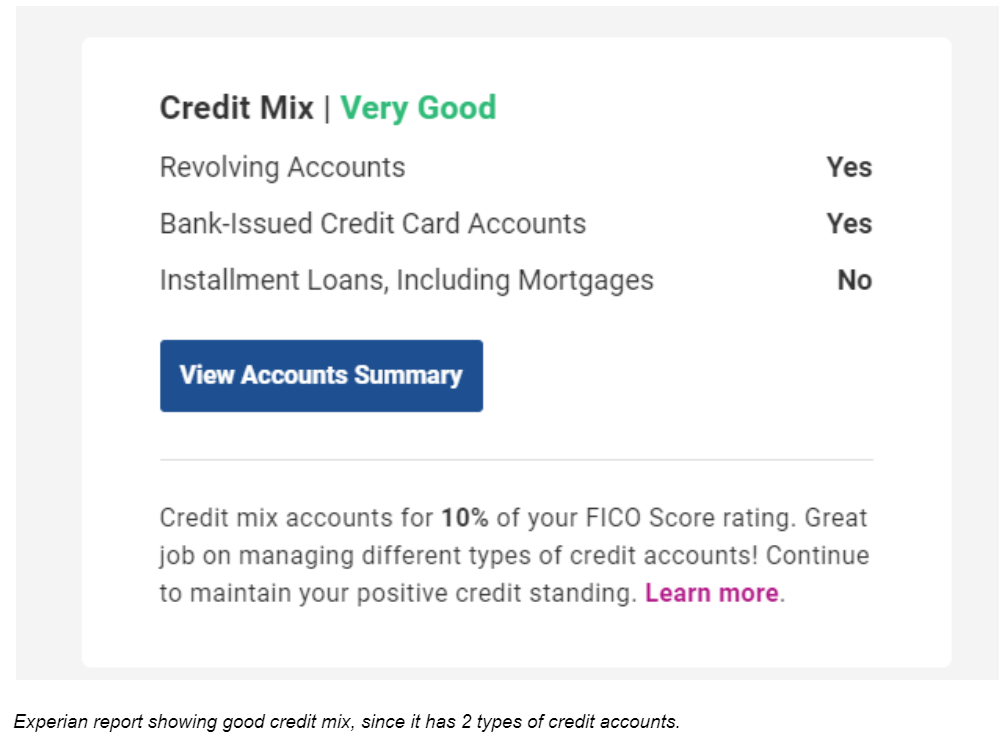

If your looking to give your credit score a boost, try using a mix of these credit types.

Three Types of Cards

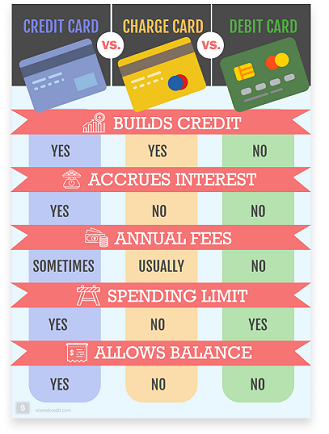

What is a debit card? A charge card is completely different than a debit card. When you use a debit card, the bank takes the money out of your account that instant. You don’t have a statement to pay every month, it doesn't build your credit, and you don't earn any rewards.

What is a credit card? A credit card is an electronic card issued by a bank, business, etc., allowing you to purchase goods or services, balance transfers and/or cash advances. A credit card allows you to pay off your debt over time. You need to make at least the minimum payment every month by the due date, and pay interest on the remaining balance.

What is a charge card? A charge card—like a credit or debit card—is a type of electronic payment card used to make everyday purchases. Charge cards look like credit cards, function like credit cards, and have many of the same features as credit cards. But, there’s a key difference between a charge card and a credit card: A charge card doesn’t allow you to roll over your balance. You must pay the balance in full every month.

You’ll receive your statement either online or via mail depending on what you’ve opted into. Once you receive your statement, pay your balance in full using one of the provided payment methods (typically you’ll pay directly from your bank).

You don't pay any interest when you use your charge card because you're required to pay your balance in full. Instead of making money off interest, charge card companies make most of their money off late payments and annual fees.

One major benefit of using a charge card is that it doesn’t have a spending limit. Unlike credit cards that bring down your credit score if your utilization is too high, charge cards build your credit without this piece.

Here’s a scenario to explain the difference between a charge card and a credit card:.

You buy a $1,000 worth of stuff on your credit card. When your statement comes out, you have two options: pay the balance in full or pay the minimum payment. If you pay the minimum payment, interest accrues on your remaining balance until it’s fully paid. (Your minimum payment is usually around 3%, so you may pay $30 every month on a $1,000 purchase .) Though the second option gives you lots of time to pay off your bills, it also means that you’ll be paying much more than $1,000 due to the high interest rates on credit cards.

If you make that same $1,000 purchase with a charge card, you only have one option when the statement comes out: pay the balance in full. Even though you made the purchase using credit, you don’t have the option of paying it off in monthly installments like you do with a credit card. If you are unable to pay the balance, you’ll be charged a late fee. A payment made later than 30 days will show up as a late payment on your credit report.

Why would someone get a charge card?

There are a few reasons why someone would get a charge card. Some of the best features of a charge card include:

- Rewards and perks – Many charge cards offer cash back and travel rewards as well as roadside assistance, extended warranties, car rental insurance, travel insurance, and more.

- No preset spending limit – Unlike credit cards, charge cards don’t have a maximum credit limit. You can spend however much you want as long as you’re able to pay it off in full.

- No interest – Because you must make payments in full every month, you don’t pay any interest with charge cards. You also don’t have to worry about going into debt.

- Builds credit without negatively impacting credit utilization – If you have a credit card, you want your balance to stay below 30% of your card’s credit limit. If your balance goes over 30%, it lowers your credit score. Charge cards, on the other hand, don’t have credit limits. You can spend however much you want without it lowering your credit score (as long as you make the full payment).

Is a charge card good for building credit?

The following factors make up your credit score:

- Payment history (35%)

- Length of credit history (15%)

- Types of credit in use (10%)

- Amount of new credit (10%)

- Credit utilization (30%)

Charge cards build your credit using all these factors except credit utilization. By simply paying your statements on time and keeping your card active, you improve 70% of your credit score. This makes a charge card an excellent way to build credit without having to worry about going into debt.

Who offers charge cards and credit cards?

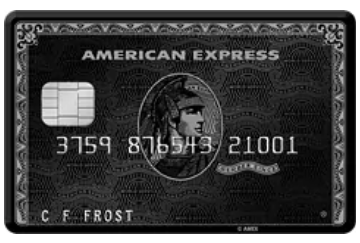

Charge cards aren't as popular as they once were. As of today, American Express is one of the only major companies still offering charge cards. They currently have four different types of charge card accounts to choose from:

- American Express® Business Gold Card

- Best for small businesses

- Has an annual fee of $295

- The Platinum Card® from American Express

- Best for travel rewards

- Has an annual fee of $595

- Centurion® Card from American Express

- Best for VIPs

- Has an annual fee of $2,500

- Has a $7,500 initiation fee

On the other hand, nearly every major bank today offers credit cards. Some major credit card issuers include:

- American Express

- Capital One

- Chase

- Citi

- Discover

- U.S. Bank

- Wells Fargo

- Bank of America

- Barclaycard

The 5 C’s of credit (and how to master them)

All this talk about good credit is not complete without the 5 C’s of credit—character, capacity, capital, conditions, and collateral? Lenders use these attributes to assess a potential borrower’s creditworthiness.

Most charge card issuers require you to have excellent credit before you apply. See how you can boost your credit by focusing on these 5 C’s.

1. Character

What does your previous work history say about you? It may seem insignificant, but lenders take into account your payment history, work experience, and interaction with other lenders when determining your creditworthiness.

The best way to show potential lenders your character is by consistently making payments on time. If this is something you struggle with, set up automatic alerts to notify you when your payment is due.

2. Capacity

Your capacity is your ability to repay your loan. The first C (character) was personal, but this C is all about the numbers.

Lenders look at your debt and liquidity ratios and your credit score to determine your creditworthiness. Make sure these numbers are in tip-top-shape before you head to the bank. (One way to do this is by paying down debt.)

3. Capital

How much money do you have to put toward a potential investment? Banks are more willing to lend you money when they see that you’ve got some skin in the game yourself. If you’re applying for a mortgage, for example, providing a down payment for a home would be one way to show capital.

4. Conditions

What are the conditions of the loan you’re applying for? These conditions include the interest rate and amount of principal for your potential loan, your credit score, and even the economy as a whole. Your credit issuer will look at these when evaluating your creditworthiness. Some of these conditions may seem out of your control, but you can increase your chances of approval by applying for credit when your credit score is at its best.

5. Collateral

Collateral is the set of assets you offer the bank to secure your loan. If you default on payments, the bank then goes after these assets. Common collateral includes items such as your home, car, or even your business depending on how it’s structured.

The Bottom Line

Charge cards are almost a thing of the past, but they can still be an effective way to build credit. A charge card might be right for you if you want to:

- Build your credit

- Avoid credit card debt

- Take advantage of rewards and perks

You can’t do much today without good credit, therefore it's important that you be completely aware of what tools are available to build up credit. It may be helpful for you to speak to a professional advisor who is available to offer you objective advice and personalized guidance as you navigate the credit industry.