In this Post:

- Age of Credit and Fico

- Authorized User: Explained

- Authorized User and Credit Cards

- Pros and Cons of Joint Accounts

- Key Takeaways

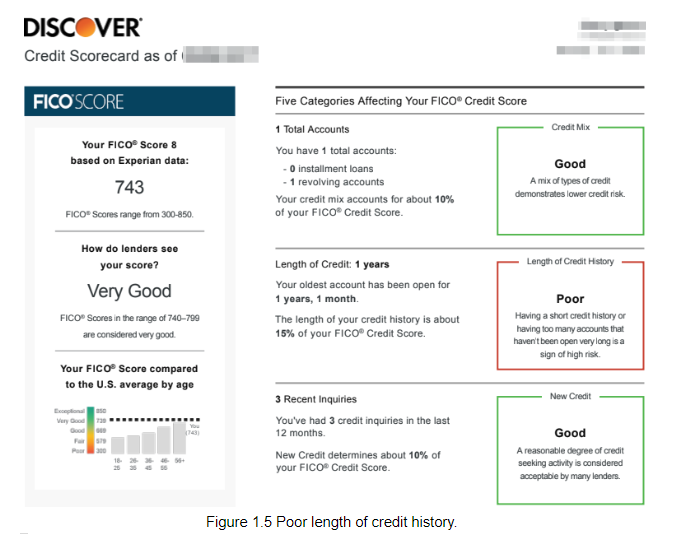

You’re desperate to boost your credit score, so you look up at what factors contribute to a good credit score. As it turns out, there are five credit score factors that make up your FICO score. One of the factors that you don’t have much control over is length of credit history.

Read on to learn more about everything you need to know about this FICO score factor.

How Does Age of Credit Factor into Your Fico Score?

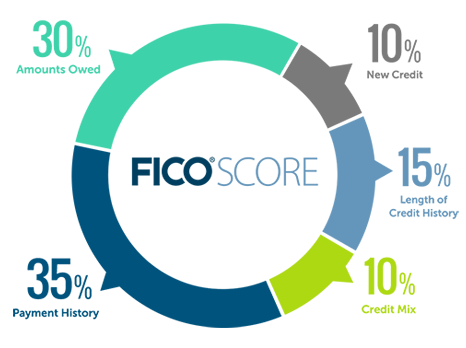

Your FICO score is made up of five credit score factors:

- payment history (35%)

- credit utilization (30%)

- length of credit history (15%)

- new credit (10%)

- credit mix (10%)

As you can see from the percentages, your length of credit history is smack dab in the middle with how important it is. It’s not nearly as important as payment history which makes up a whopping 35% of your credit score, but it’s definitely more important than your new credit inquiries, which only make up 10%.

So while age of credit is not the most important thing, it still matters.

The issue?

You can’t really control length of credit history. It’s all about the passing of time. Whereas you can control making on-time payments, limit your balances and inquiries, and manage your credit mix.

Lenders want to see how you manage your credit over time. The only way to do that is through the passage of time. Just like you want to see how your relationships, personal or professional, fair over time, lenders want to see how you manage all your credit over a period of years.

If you just opened your first credit account, your length of credit history will be limited. All you can really do is wait and make consistent payments over time.

However, there is one way that some consumers to try and hack this credit factor and that is through becoming an Authorized User.

Wanna Boost Your Length of Credit History? Become an Authorized User

An authorized user is someone who is added to a credit account and is authorized to use a card related to that account. Being an authorized user simply gets you authorization privileges. You are not legally responsible for making payments.

The main benefit of becoming an authorized user is that in many cases the primary borrower’s credit history can be added to your report.

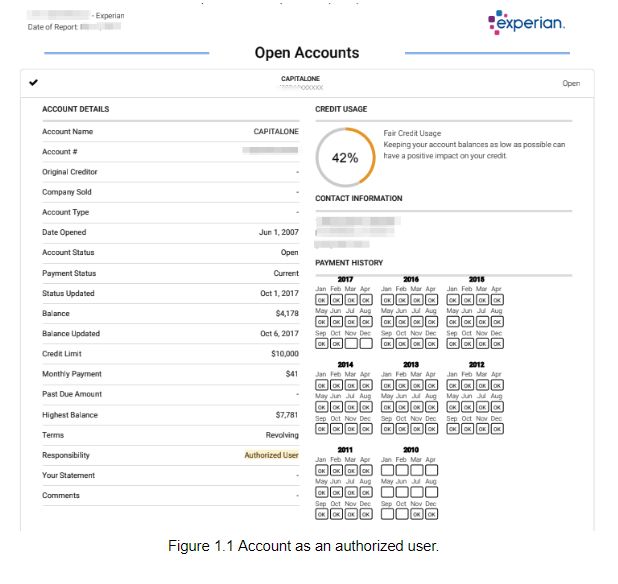

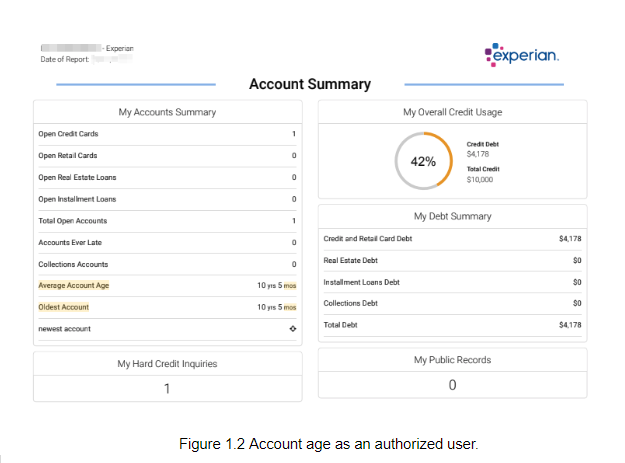

Below in Figure 1.1, you’ll see a consumer’s credit report with an authorized user designation on it. In Figure 1.2, you’ll see the decade of account history they got from being an authorized user.

As an authorized user, all of that credit history can be added to your credit report and help boost your length of credit history. As you can see, this is one way that you can manipulate this credit factor into something that is more advantageous for you — by having the primary borrower’s account history added to your credit report.

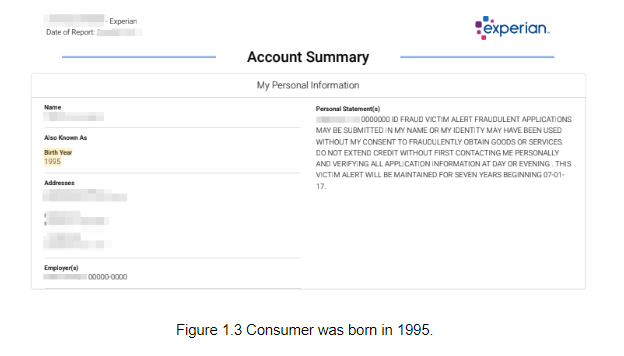

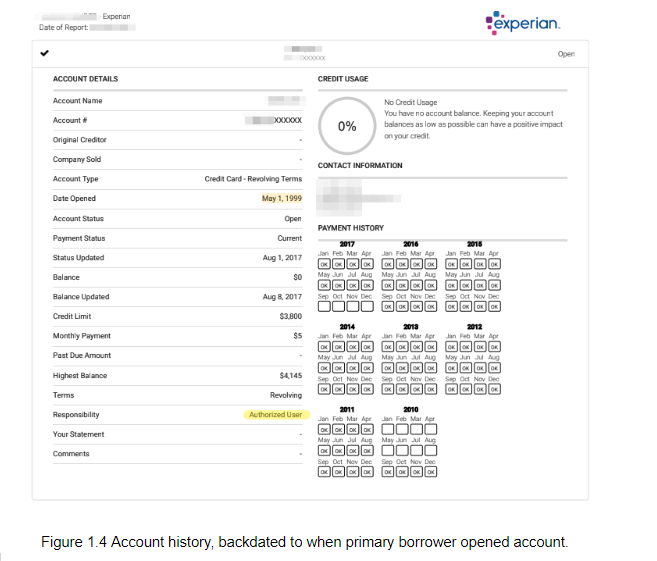

As you can see in Figure 1.3, this consumer was born in 1995. But in Figure 1.4, the backdated credit history as an authorized user is from 1999. Clearly, this consumer wouldn’t get a credit card at age 4, but the consumer was able to add all of that account history as an authorized user.

Of course if you go this route, you want to be an authorized user for someone that has good credit and a long credit history. You won’t get much benefit otherwise.

While this can be a good way to hack your length of credit history, it’s not foolproof. In fact, not all credit cards report authorized users to the credit bureaus. Also, some creditors only report to one bureau which means you can have varying account ages among the credit bureaus.

Before going this route, you want to ask the credit card issuer if they report authorized users to the credit bureaus.

Becoming an authorized user can help if done the right way as it won’t report the card as new, it will backdate and report based on the date the primary borrower opened the account. Unfortunately, this strategy won’t work with American Express, as they do report authorized user’s cards as new.

What to Know About Credit Accounts as an Authorized User

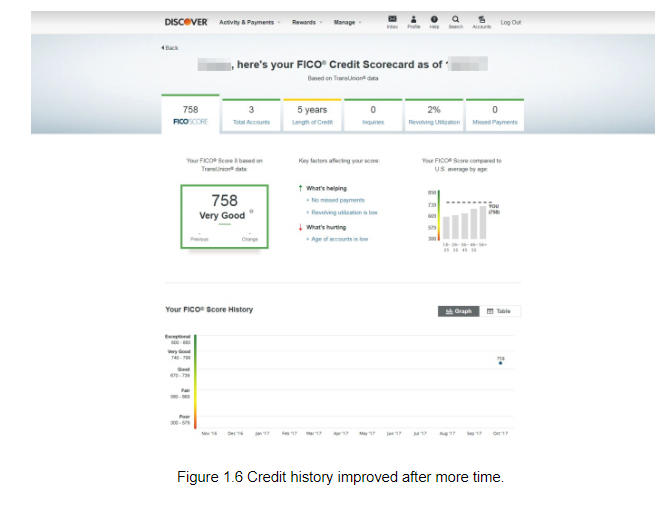

If you’re curious about this option, you probably want to know just how fast this can boost your credit. Getting reported as an authorized user can take up to several days or more than a month, depending on when the closing date is.

That’s not a terribly long time compared to waiting out months and years to boost your length of credit history on your own. This is why this can be an attractive option for people with limited credit history.

If you opened a new card before becoming an authorized user and are thinking of canceling, stop right there.

You cannot boost your length of credit history if you cancel new cards.

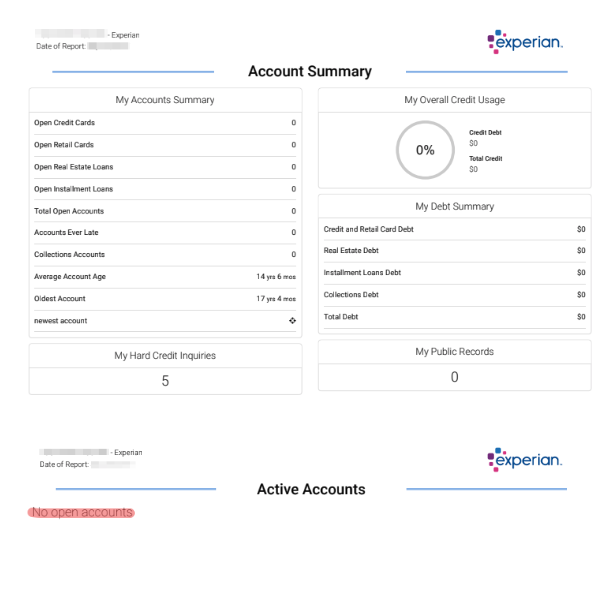

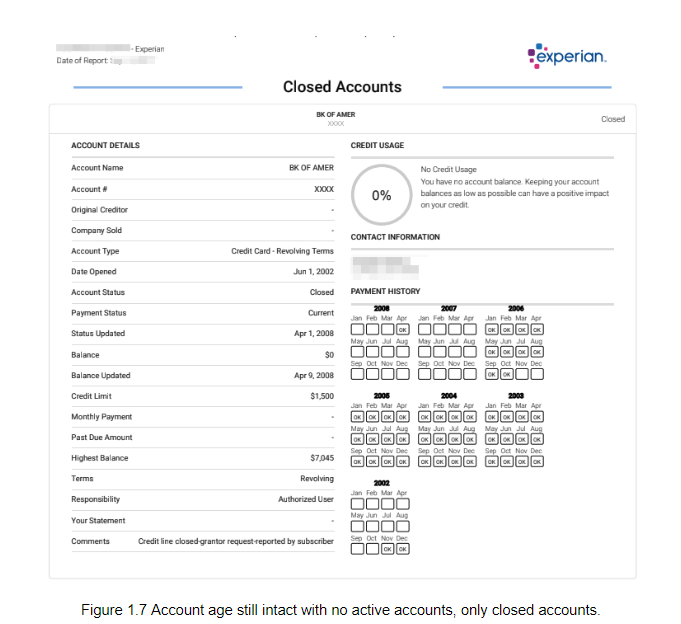

FICO still counts closed accounts. Figure 1.7 that shows an account age that is still intact even though there are no active accounts, only closed accounts.

Though FICO will still count your account age, it’s important to keep your credit accounts open and in use. If there is a card that you don’t use that often, consider only using it for groceries or to pay your utilities. Closing your accounts is almost never a good idea if you want to get the most out of your length of credit history.

What About Joint Accounts to Improve Age of Credit?

Thinking of boosting your length of credit history through a joint account? As a joint card holder, you are an equal partner on the account and have full responsibility, unlike an authorized user who just has payment privileges.

Unfortunately, this isn’t a very good solution as it’s treated as its own card. Not only that, but not many banks allow for joint credit cards. However, people who do have old joint accounts are considered to have old accounts individually.

So while being an authorized user may seem like your go-to route to combat a length of credit history issue,

our data shows that many creditors can check and differentiate between a primary borrower and authorized user.

Due to this, they can reject future applications for credit citing that you are too new with credit and don’t have an established history. Every creditor has their own criteria, so it’s tough to say what will fly and what won’t. Prime creditors can have even tougher requirements.

Age of Credit Takeaways

Age of credit accounts is a contributing factor to your credit score but not nearly the most important thing to focus on. There’s not much you can do except be patient. If you’re eager to try and boost your credit score, becoming an authorized user on someone else’s account who has a long age of credit and is in good standing, can help.

For now, focus on making sure all your payments are on time and your balances are kept below 30%. All of these ingredients put together can make a recipe for improved credit.