In this Post:

- Vantagescore: A Breakdown

- What’s a Good Vantagescore Range?

- What Influences Your Vantagescore?

- 2 Types of Scores

- Access Free Vantagescores

- Who Uses Vantagescores?

If you’ve ever applied for an apartment, a loan, or credit card you know that your credit score can make or break you. That three digit number holds a lot of power and can open doors — or close them shut.

When you think of your credit score, you’re likely familiar with the FICO (Fair Isaac Corporation) scoring model. But did you know there is actually more than one credit scoring model?

One of the most popular credit scoring models, aside from FICO, is VantageScore.

Read on to learn more about what exactly the VantageScore is, how it is used, and how it differs from the FICO score.

Origins of the Vantagescore

In 2006, the three credit reporting bureaus — Experian, TransUnion, and Equifax — came together and created their own proprietary credit scoring model, the VantageScore.

Essentially the VantageScore is another type of credit score that assesses a consumer’s creditworthiness and risk to lenders.

The Vantagescore Range Explained

Similar to FICO, VantageScore also has a numeric credit score. Consumers typically have different FICO and VantageScore credit scores, as they are two different models.

The range for VantageScore 2.0, an earlier model that was released, was 501–990. The range for VantageScore 3.0 takes after the FICO model and is 300–850. The higher the number, the better the credit score.

So if you want to know what is considered a good VantageScore credit score, think 700 or above.

The VantageScore 4.0 has built upon the VantageScore 3.0. According to the VantageScore website, “VantageScore 4.0 is the first and only tri-bureau credit scoring model to incorporate trended credit data newly available from all three national credit reporting companies.”

On top of the three-digit credit score you’re likely used to seeing, the VantageScore also has an alphabetical score from A to F. Like in school, you want to aim for that A, which is the best in terms of creditworthiness.

Factors Influencing Your Vantagescore

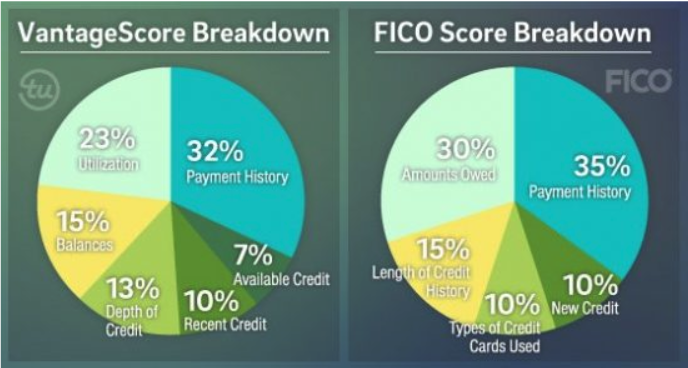

When it comes to VantageScore credit scores it’s all about influence. Each factor has a level of influence on how it will affect your credit score.

For example:

- Your payment history is “extremely influential”

- Your type of credit and credit utilization are considered “highly influential”

- Your total balances are “moderately influential”

- Your new credit inquiries as well as your available credit are “less influential’

The Differences Between Vantagescore and Fico

If you want to get your credit score, it’s likely you’ll come across your FICO score or VantageScore credit scores. But what exactly is the difference between VantageScore and FICO?

The two are similar, especially with the release of VantageScore 3.0. Both models have three-digit numeric values that range from 300 to 850, which determine creditworthiness.

Also, the determining factors like payment history and credit utilization are at the top when it comes to determining credit score. However, the VantageScore describes these factors with influence whereas FICO gives percentages.

For example, your payment history accounts for 35% of your credit score.

One major difference, which is a good thing for consumers new to the credit market, is that the VantageScore can produce a credit score sooner than the FICO scoring model. Using the FICO model, you need to have a credit history of at least six months to produce a score. Using the VantageScore, you only need to have a credit history of one month.

According to VantageScore, their credit scoring model empowers 30–35 million consumers who would be considered “credit invisible” under other mainstream models. Establishing a VantageScore quickly may help consumers who are just starting their credit journey to be considered by lenders.

Another key difference is that VantageScore and FICO rate late payments a bit differently.

For example, late mortgage payments carry more weight for VantageScore than other types of late payments, like a credit card. The VantageScore also allows consumers a 14-day period to check out rates for things like mortgages or car loans — and counts it as a single inquiry, compared to a 45-day period for FICO.

Additionally, VantageScore may put more stress on credit utilization than the FICO model.

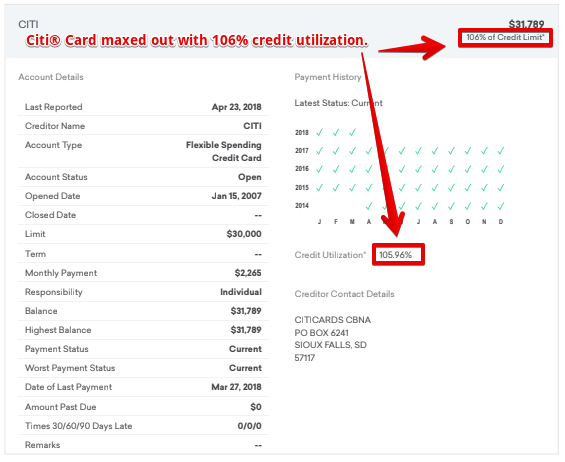

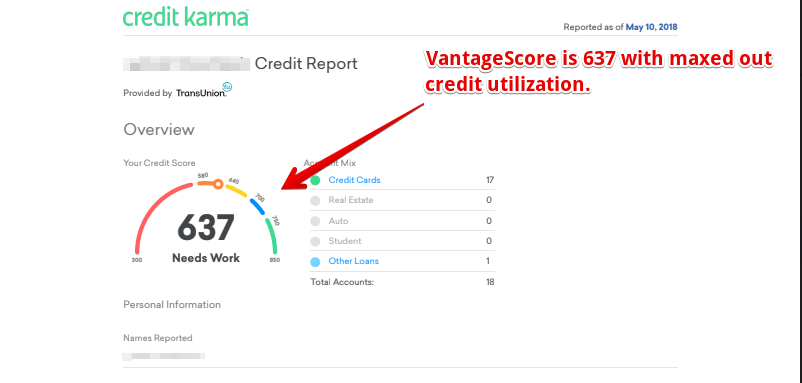

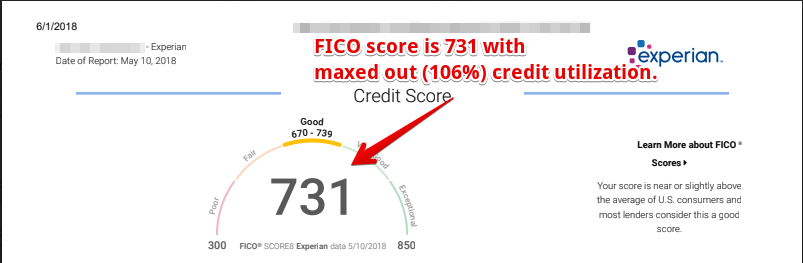

For example, Scored Credit™ data has shown a stark difference in FICO score vs. VantageScore when the balances are maxed out and the credit utilization is high. Below, you can see this consumer’s account has a credit utilization of 106%.

In this case, the consumer’s VantageScore is 637 whereas the FICO score is 731. This shows us that credit utilization may play a more important role for VantageScore than FICO, as the VantageScore is nearly 100 points less than the FICO score.

Figure 1.1 Citi® Card maxed out with 106% credit utilization.

Figure 1.2 VantageScore is 637 with maxed out credit utilization.

Figure 1.3 FICO score is 731 with maxed out (106%) credit utilization.

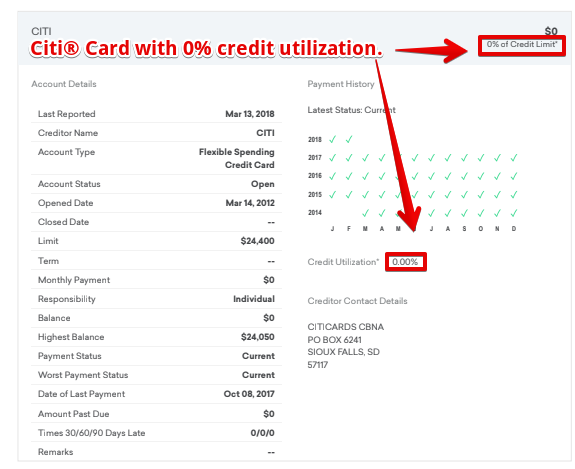

Figure 1.4 Citi® Card with 0% percent credit utilization.

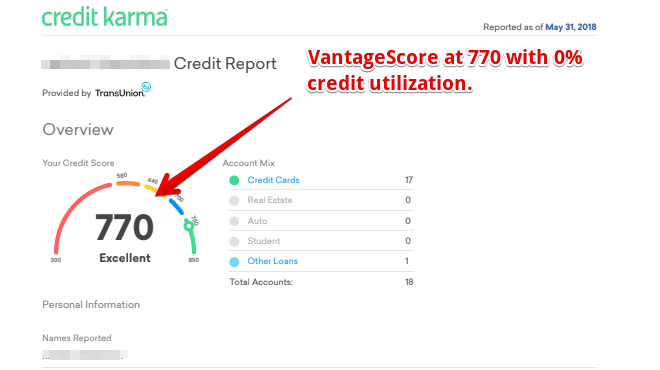

Figure 1.5 VantageScore at 770 with 0% credit utilization.

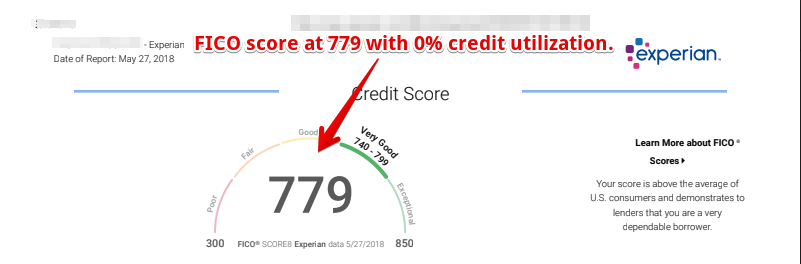

Figure 1.6 FICO score at 779 with 0% percent credit utilization.

So from Scored Credit™ data we can say that credit utilization and overall balances may have a greater impact with VantageScore. In other cases, sometimes there’s a big difference between VantageScore and FICO scores, and the immediate reason isn’t necessarily known. Each model has their own proprietary scoring methods, so it’s hard to know for sure.

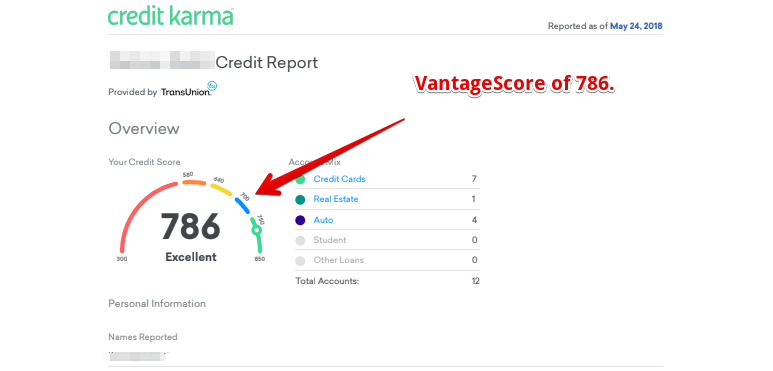

For example, Scored Credit™ data shows that the same consumer can have different scores, even though everything is the same in the credit profile. In the screenshot below, a consumer has a VantageScore of 786 but a FICO score of 700.

Figure 1.7 VantageScore of 786.

Figure 1.7 VantageScore of 786.

In this case, with the same consumer, there’s an 86-point difference between the two scoring models. While that can be alarming, the key to remember is that all of this is in a range and both of these numbers are still good when it comes to being creditworthy and assessed by lenders.

Check out Your Vantagescore for Free

While the fact remains that many lenders use the FICO scoring model to determine creditworthiness, the VantageScore can give you a similar score and offer an idea of where you’re at.

Where can you get your free VantageScore? Credit Karma offers a free TransUnion and Equifax VantageScore and can help you monitor your credit, too.

Who Exactly Looks at Vantagescores?

Do credit card issuers use VantageScore?

Do mortgage lenders use VantageScore?

According to VantageScore, 8.5 billion VantageScores were used from June 2016 to July 2017. Out of those scores, 75% were used by a variety of lenders, including credit card issuers, personal loan companies, auto lenders, mortgage lenders, and financial institutions (like banks and credit unions).

Your VantageScore can help you understand how creditworthy you are. While it’s not the same as the ever-popular FICO scoring model, it’s similar and can be used to your advantage.