In this Post:

- How Credit Card Due Dates Work

- When You Miss Payments

- How Late Payments Impact Your Credit Score

- Consistently Late Payments

- The More Overdue Your Payment Is, The Bigger The Impact Will Be

- Charge Offs

- Removing Late Payments From Your Credit Report

- How The Grace Period Can Help Protect Your Credit Score

Missing even one payment can have a negative impact on your credit. You might get hit with a late fee, be forced to pay higher interest rates, and wind up with a lower credit score. A lower credit score can affect your ability to get credit in the future and require a higher interest rate before getting a loan

How Credit Card Due Dates Work

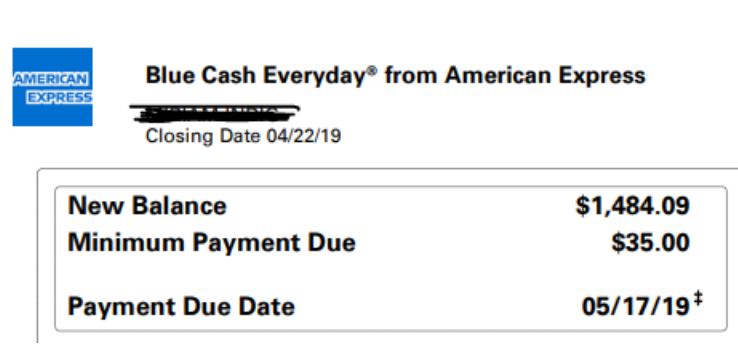

Your credit card payment due date is typically 21-25 days after the closing date, depending on what your credit card agreement states. If you pay the entire balance due before the end of this grace period, you will avoid paying any additional interest payments.

Your payment is considered late if it’s more than 30 days from your billing due date. After 30 days, the credit card company can report the delinquency to the credit reporting agencies.

When You Miss Payments

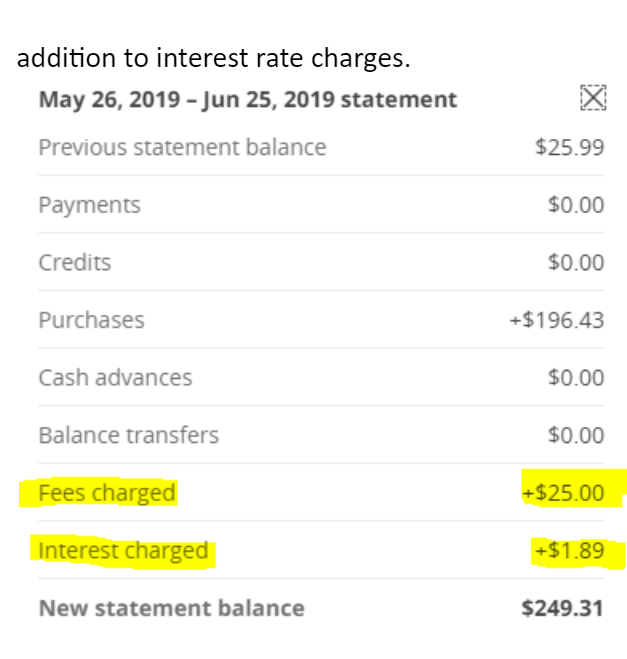

If you pay your credit card after the due date, your provider can charge you a late fee. This is typically $25 for the first time and $35 for multiple late payments, in addition to interest rate charges.

Continuing to miss the due date can lead to more late fees and an increase in your interest rate. Let’s say you have an outstanding balance of $5,000 and a 21% interest rate. Missing two months could cost you late fees of $60, plus accrued interest of more than $175.

Here’s what a missed payment might look like over two missed payment cycles:

Beginning Balance

$5,000

First Missed Payment

Late Fee: $25

Interest: $87.50

New Balance Owed: $5,112.50

If you don’t pay the balance after the first missed payment cycle, interest fees will be applied to the late fee and interest accrued during the initial first payment, as shown below:

Second Missed Payment

Late Fee: $35

Interest: $89.47

New Balance Owed: $5,236.97

You can pay up to and on the 30th day, but if it goes past that, you will be considered delinquent and can be slapped with a late fee. The standard reporting guideline for credit bureaus is that late payments don’t typically show up on credit reports until the payment itself is 30 days past due.

How Late Payments Impact Your Credit Score

How one late payment will impact your credit score depends on several factors, including how much credit you have, how long you have established credit, and whether it’s the only blemish on your report. If your payment is more than 30 days late, credit card providers can report the past due bill to the credit reporting agencies. Since payment history information can account for as much as a third of your credit score, one late payment can negatively impact your score.

Those with higher scores are more likely to see a more significant impact initially. Higher scores are built with a solid record of using credit responsibly and making payments on time. A missed payment is out of character and may signal a change in your ability to pay. Those with high credit scores are penalized more heavily than those with lower scores that may already have credit blemishes. Someone with a FICO score of 780 might see a drop of 90-100 points after just one 30-day late payment. A consumer with a 720 FICO score (because of other late payments) might only see a 20-30 point drop with one late payment, because their score was lower to start with.

The impact of one late payment is most when it’s recent, and will diminish over time. How long it will impact your credit score depends on different factors such as your total credit history and whether you’ve had other late payments or defaults. The fewer blemishes you have, the less it will affect your ability to get credit in the future.

If you’re starting out with good credit, one late payment likely won’t downgrade your score from good to fair or poor. If you pay off the missed payment and any late fees immediately (and don’t miss future due dates), you can see you credit score begin to rebound in as short as a few months. If you already have fair or poor credit due to other credit problems, it can take a year or two to bounce back. Either way, make sure you pay your outstanding bills and debts as quickly as possible, so that your score is no longer negatively impacted.

One late payment will likely not have a long-term impact on your credit score as long as you have an established credit history. You may be asked to explain the reason for the late payment on future credit inquiries. You score may dip initially, but will rebound over time.

Consistently Late Payments

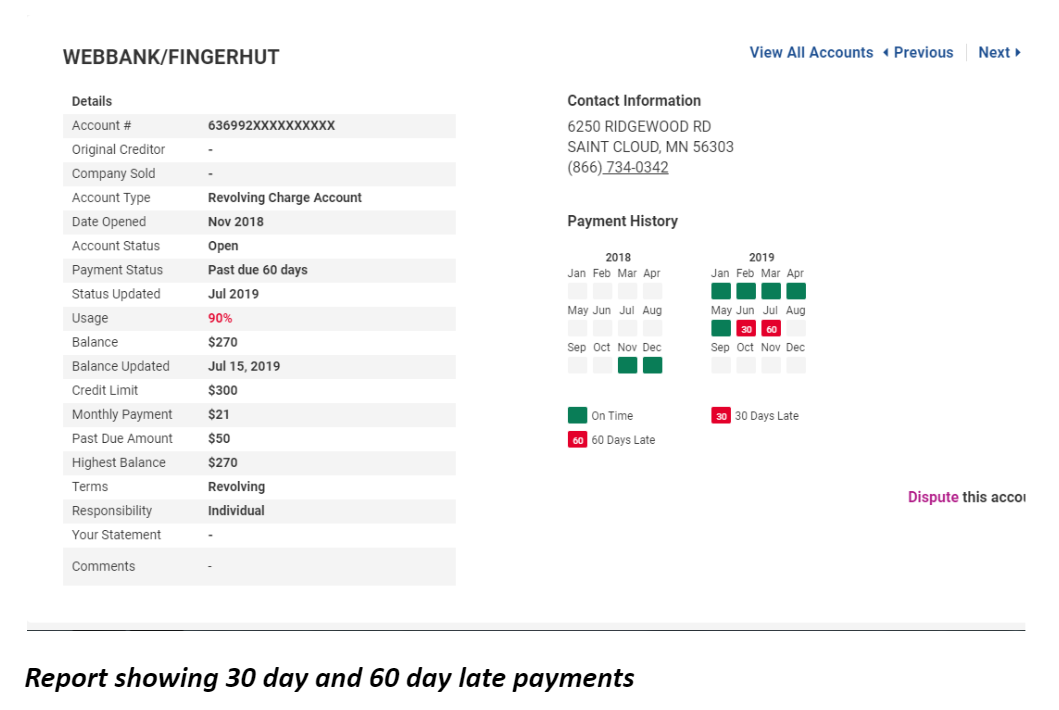

Consistently late payments will have a bigger impact on your credit score. The more late payments you have, the bigger the impact. If you apply for auto loans, mortgages, or other credit cards, you may have a more difficult time securing credit or wind up paying a higher interest rate.

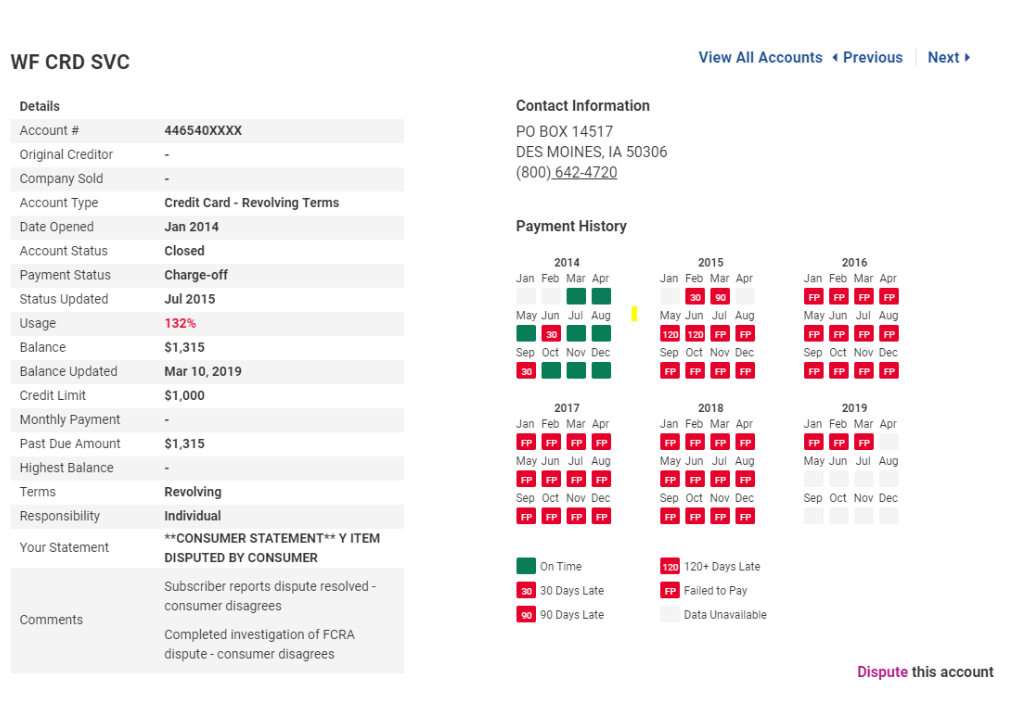

Late Payments On Closed Accounts

A closed account can still affect your credit score if there were late payments, missed payments, charge-offs, or if your account was sent to collections. These marks on your credit score will stay on your record for seven years.

The More Overdue Your Payment Is, The Bigger The Impact Will Be

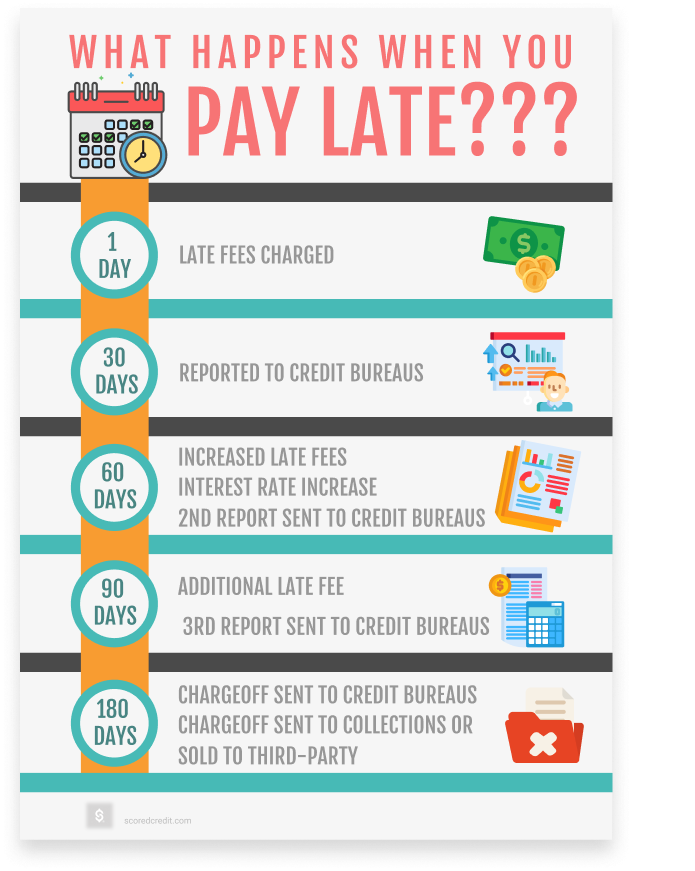

You can be charged a late fee as early as a few minutes after your payment is late. Even paying one day late can accrue a late fee.

Credit card companies can report late payments 30 days after the due date if minimum payments haven’t been made. Late payments typically don’t show up on your credit report for at least 30 days after you miss the payment. Some lenders don’t report late payments until they go 60 days past due.

Late payments can be reported for 7 years after the date of the delinquency.

After 30 Days

The late payment won’t be reported to the credit reporting agencies until you’re 30 days late. You can also still face other consequences of the late payment, including a late fee.

You may be able to get a late fee waived if it’s the first time you’re late with a payment. Call the credit card issuer and ask for a waiver. Whether it affects your credit score will depend if the delinquency is reported to the credit bureaus. If they choose not to report a late payment, it will have no impact

After 60 Days

In addition to late fees, you may also see your interest rate go up to the highest allowable interest rate. Further, your lender can apply this penalty rate to your balance every month until you’ve made six consecutive on-time payments.

After a payment is 60 days late, the card issuer will report a second missed payment period (30 days and 60 days). This second report will be treated more serious than the first.

After 90 Days

If an account shows 90 days past due, someone looking at your credit report can fairly assume it was also 30 days late and 60 days late at some point. Even if the late payment was not reported at 30 days or 60 days, the 90-day delinquency will have the same impact as if the 30-day and 60-day missed payments had been reported.

This delinquency will hurt your credit score and can stay on your record for seven years. If it happens once, lenders will see you as more likely to repeat. Because of this, your credit score will decrease, and lenders may view you as a credit risk. Missing multiple payments, especially if they are recent, could make it difficult to get additional credit.

However, these late payments won’t have such a big effect as time goes by. For example, a late payment that is 3-4 years old will be on your report, but it wont bring down your score that much and you’ll be able to get approval for new lines of credit.

After 180 Days

After 180 days (six months) of non-payment, your account may be charged off (see below) and/or sold to a third-party collection agency. When this happens, it is more serious and will be reported in your credit files and lower your credit scores further.

Your account can even be charged off if you've been sending payments, but those payments were always less than the minimum due. You will have to bring your account current by paying the full minimum payment if you want to avoid a charge-off.

What Happens When You Pay Late?

Making late payments is one of the worst things you can do for your credit. Exactly how bad is it? That depends on how late your payments are. Your late payment can result in fees and negatively affect your credit score.

Charge Offs

A charge off is one of the worst things you can have on your credit report. This occurs when a creditor reports that a debt is unlikely to be collected. Traditionally, creditors make this declaration at six months without payments. There is a tax advantage for companies to declare your debt as uncollectible, but it doesn’t relieve you of the debt. You still owe the money. It may be sent or sold to a debt collection agency. All of these can dramatically hurt your credit score.

You can avoid the charge off by making at least the minimum payments on your credit card each month. If you are 4-5 months late on your payment, you will need to bring your account current before the six-month mark to avoid the charge-off.

No matter what, you still owe the debt: You’re responsible for paying the bill. Even if there is a charge-off on your credit report, having it marked as paid will look better than having it unpaid.

In order to rebuild you credit after this occurs, you will need to pay off the outstanding debt and make sure you pay other accounts on time. You should also know that it will take some time for your credit rating to improve.

Removing Late Payments From Your Credit Report

You can dispute anything on your credit report with the three major credit bureaus. If the lender fails to respond within 30 days, the late payment will be deleted. If you find an error in reporting, make sure you to file a complaint with the three major credit bureaus.

If it’s not an error, you will need to contact the credit provider directly and make an appeal.

If you are wondering how to get a creditor to remove a late payment, your best option is to appeal to the credit card company explaining why your payment is late and ask for record of the late payment to be removed. Commonly called a “Goodwill Letter,” some credit card companies will reconsider your situation upon receipt of the letter if you have an otherwise solid payment history. However, they are not required to do so.

A typical goodwill letter would take full responsibility for missing the payment, describe the circumstances which caused you to miss the due date, and a polite request to remove the late payment report. You will need to be current on the account (making up any missed payments, late fees, and interest charges) and it also helps if you’ve made a few more on-time payments to demonstrate that one missed payment was inconsistent with your credit history.

How The Grace Period Can Help Protect Your Credit Score

The grace period refers to the amount of time when a lender will not report a missed payment. Typically, you must miss a full payment cycle before a late payment gets reported. This can vary between 21-30 days depending on your credit card provider.

Making payments before the end of the grace period means you will avoid late payment fees and delinquency issues. You won’t, however, be able to avoid interest if paid after the due date.