In this Post:

- Fico Score: Explained

- Fico Score vs. Credit Score

- Fico Score Versions

- Mortgages and Fico Credit Scores

- Fico Scores and Credit Cards

- Fico 9

- Recommended Fico Score 8 Range

- Why Fico Matters

You’ve probably heard the term “FICO score.” Did you know there is actually more than one?

Yep, it’s true.

There’s not just one FICO score that is standard that everyone uses. This can make understanding credit scores a bit confusing, so we’re going to share just how FICO credit scores work and go over the various FICO score versions.

Fico Score: Defined

First, let’s go over what a FICO score really is. A FICO score is a type of score that signifies your creditworthiness to lenders. It’s a three-digit number that shows how risky you are as a borrower to a lender. The higher the score, the better!

The Difference Between a Fico and Credit Score

It can be confusing to understand what a FICO score is in the grand scheme of things. Is there a difference between a credit score and a FICO score? In reality, a FICO score is a type of credit score. There are various different credit scoring models aside from FICO, such as the VantageScore. So credit scores are something general, a FICO score is something specific.

There Are over 50 Fico Score Versions. Here’s Why.

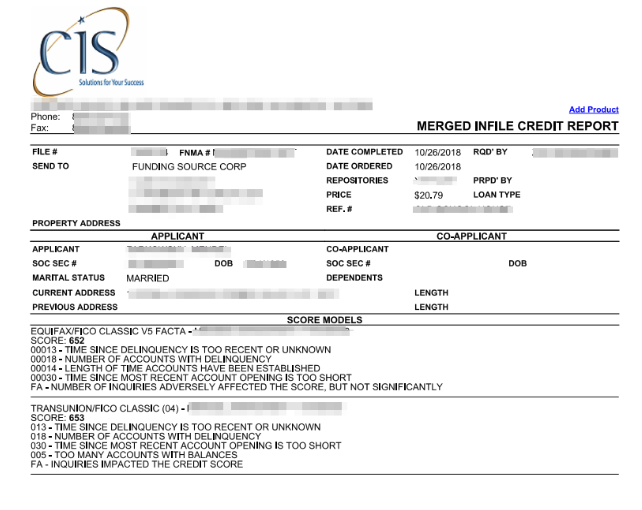

When it comes to credit scores, FICO is king. FICO scores are used in over 90% of lending decisions. But there isn’t just one type of score. In fact, there are over 50 FICO scores. How can this be?

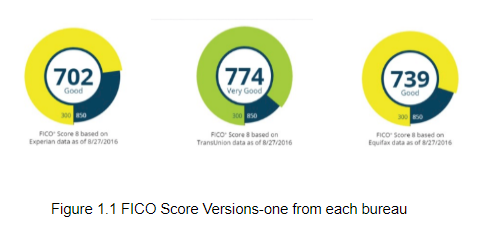

Well, for a few reasons. First, every credit bureau (TransUnion, Equifax and Experian) has their own FICO score. While creditors report information to the credit bureaus, they don’t necessarily report to all three of them, and this can cause variations in your FICO score.

The information in your credit report is what determines your credit score so if only some of your information is reported, it will cause a variation. Below in Figure 1.1 you can see that there are three different FICO scores for the same consumer.

On top of that, there are industry-specific FICO scores too. There can be specific FICO scores for auto loans, credit cards, mortgages and more.

In general, the FICO score range is 300–850. Consumers looking for their FICO credit score will be in this range. However, industry-specific FICO scores are typically a different range — 250–900.

Aside from the differences between credit bureaus and the industry-specific scores, there are also various updates to the FICO scoring model. For example, FICO Score 8 is the most common FICO model in use.

But when it comes to mortgages, lenders use FICO Score 2, FICO Score 4, and FICO Score 5.

As you can see, all of these factors make up a lot of different FICO scores. There are different FICO scoring models to stay current, but each industry or lender may have their preferred model to use.

Mortgage Fico Credit Scores: An Overview

While there have been various updates through the years in the FICO credit scoring model, the mortgage industry is stuck in the past.

FICO Score 8 is the most common score that is used but when it comes to mortgages Experian uses FICO Score 2, Equifax uses FICO Score 5 and TransUnion uses FICO Score 4.

Why does this matter to you?

Well if you sign up for any credit monitoring, you’ll typically receive your FICO 8 credit score. Given that mortgage lenders use a different FICO scoring model, you won’t have a perfectly accurate picture of what credit score they see. If you’re in the market to buy a home and get a mortgage you can consider buying the various FICO score versions that are used for mortgages on myFICO.

It’s important to know what type of FICO score the lender uses because you may think you know your score and then get a denial letter because the lender uses a different scoring model.

Which Fico Score Is Used When Applying for a Credit Card?

When you apply for a credit card, your FICO Bankcard Score is used to assess your creditworthiness. But with all the various credit scoring models out there, it can be helpful to know which score the lender uses.

Below is information we’ve compiled regarding which scoring models are used for these lenders. This is Scored Credit™ internal data and research may change at any time.

- American Express — FICO Score 8

- Barclaycard — FICO Score 8

- Bank of America — FICO Score 8. Bank of America seems to state that they may use a different range but given the numbers, it looks like FICO Score 8

- Capital One — TransUnion FICO score 4. Capital One pulls from all three credit bureaus, similar to banks that offer mortgages.

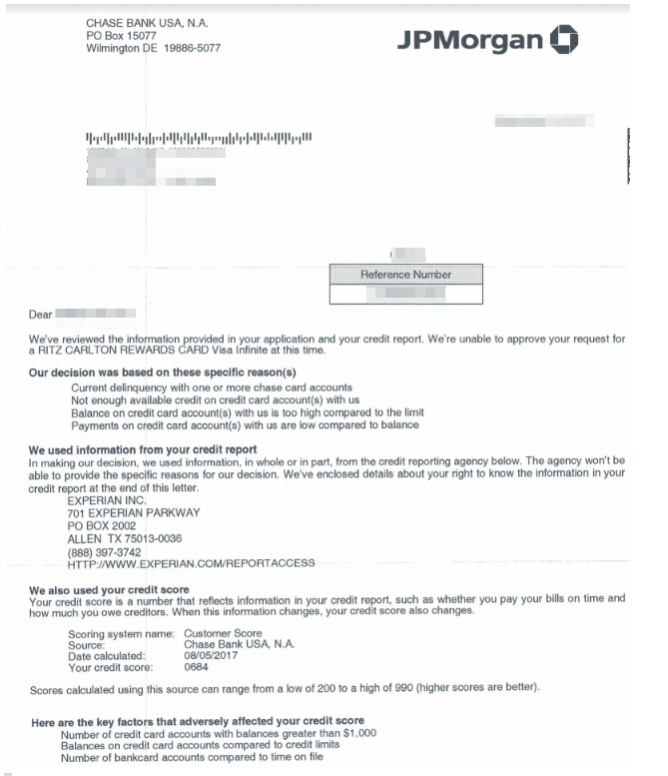

- Chase — It is toughest to find Chase’s credit score models and different information is out there. As you can see in the letter below, the credit score range is not traditional, and they have their own specific type of score.

- Citi — FICO Bankcard 8

- Discover — FICO Score 8

- Wells Fargo — FICO Score 8

- Fifth Third — FICO Score 8

- Penfed — FICO Score 8

When it comes to the FICO Bankcard scores, banks tend to put more emphasis on high credit utilization. So if you’re applying for a credit card, be sure to keep your account balances low, ideally less than 30%.

What to Know About Fico Score 9

FICO Score 9 has been introduced to reflect the following changes:

- Accounts in collection that have been paid off won’t have a negative impact any more.

- Medical collections won’t have the same impact as other types of debt in collections.

- If reported, rental history can help your credit score.

Though myFICO states that many lenders are in the process of upgrading, our data states that most lenders are still using FICO Score 8. However, Wells Fargo does offer their customers FICO Score 9.

Fico Score 8: What’s the Best Range?

Seeing as FICO Score 8 is the most widely used credit score, you want to know what is the best range. What makes a good credit score or a bad credit score under the FICO Score 8 credit scoring model?

According to myFICO, if you have a score of 579 or lower, your score is Poor. A score of 580 to 669 is Fair and a score from 670 to 739 is Good. If you have a score of 740 to 799 your score is Very Good. An Exceptional score is 800 and above.

So if you want a good credit score aim for 670 or above.

Obviously, the higher the better!

In order to boost your FICO credit score, be mindful of your account balances (you want them low) and pay all your bills on time. Also, don’t go crazy applying for new credit and keep your accounts open.

Why Different Fico Score Versions Matter

As you can see, there is not just one FICO credit score. There are many different FICO score versions depending on the industry and the credit bureau. Knowing these nuances can help you if you’re applying for a specific type of loan or credit.