In this Post:

- Joint Credit Cards: An Overview

- Joint Credit Cards and Your Credit Score

- The Top 4 Joint Credits Cards Available

- Differences Between Joint Cards and Authorized Users

- Joint Credit Cards Key Takeaways

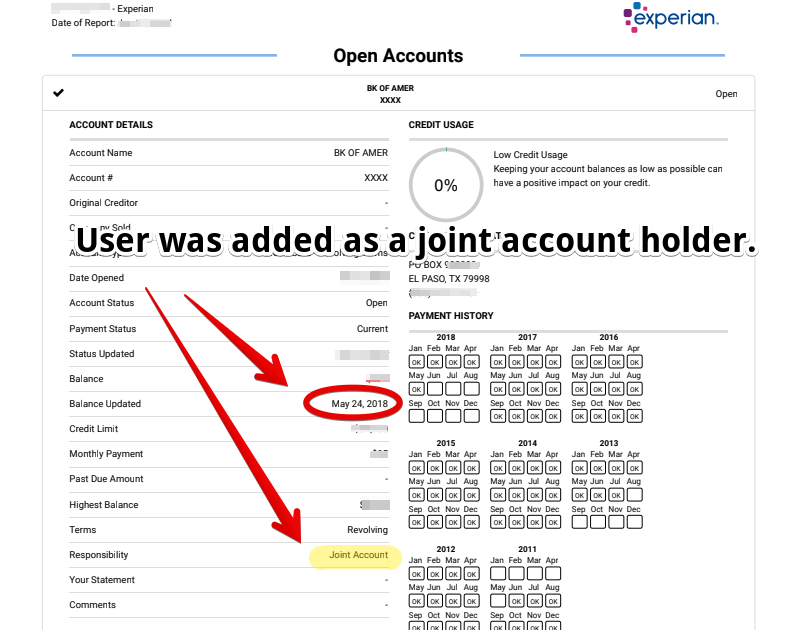

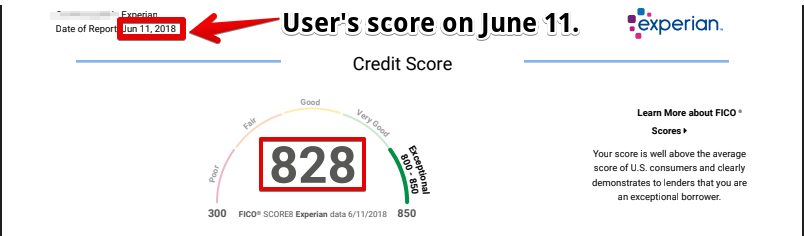

Being added as a joint user on a credit card who is held by someone with good credit is one of the best ways to instantly boost your credit score.A joint card is considered your own card, not like an authorized user; that's only an authorization to use the card.So, by becoming a “Joint” to an older card, you get true history of the cardholder that held the card until now.

But now it's truly yours as well.

While paying off balances is also guaranteed to increase the score, this way is a great alternative. Now, as with any cards of course, there are things you need to be aware of before you go through with it… Read on.

A Joint Credit Card Can Make or Break Your Credit Score

A joint card is just what it sounds like—it’s a joint credit card where two people are the primary account holders. Under a joint credit card agreement, you both have the same rights and the same access to the card. You will each have your own card to use but both of your names will be on the account. In other words, both cardholders can:

- spend

- make payments

It also means that each cardholder is legally responsible.

So, let’s say your partner is supposed to pay the bill but doesn’t. (Bummer.) This could affect you and your credit in a negative way. It’s important to be mindful of the consequences of having a joint card.

Choosing the Right Joint Credit Card to Build Your Credit Score

If you’re going to get a joint card with your spouse or partner you should know the pros and cons of joint credit card accounts.

One of the main pros is: Easy access for each partner. It’s easy to make shared purchases and you don’t have to pay each other back or figure out who should pay for things. On top of that, a joint card can help build credit for the other party in certain cases.

So, if you’re wondering, “Can you build credit with a joint credit card?” The answer is, yes, it’s possible!

The account would show up as “Joint” on your credit report, but it can still have a positive impact on your credit score.

Let’s say that you have killer credit. You’ve had an account with Bank of America for 10 years and you have a good credit history. You call the bank and ask to have your spouse added to the account as a joint account holder.

As a joint account holder, your spouse will benefit from your good credit history.

In fact, Scored Credit™ has had instances that users went from zero credit all the way to getting approved for a mortgage after being added for six weeks to two joint accounts with good credit history.

That says a lot!

As joint account holders, you can build credit together with a good credit history, by:

- making payments on time

- keeping your balances low.

On the other hand, you can also affect each other adversely. If you or your spouse have bad credit and have a joint account, it could have a negative impact.

Also, if you have great credit now, but your spouse fails to make a payment, it can hurt your credit.

Getting married or being in a relationship carries some level of risk and the same goes for having a joint credit card. It’s key that you communicate and trust each other as your credit is in the hands of your partner!

The Top 4 Joint Credits Cards Available

Ready to get a joint card? Something to note is:

Joint credit cards aren’t as easy to come by as you might think.

Not every financial institution offers joint credit cards.

The financial institutions that do offer joint credit cards include:

- Bank of America

- Discover

- US Bank

- Wells Fargo

It should be noted that while Discover does offer joint accounts, it’s not allowed on an existing card, only if you add someone as a co-signer. In that case, it may not be as helpful to build credit.

Is a Joint Credit Card the Same as Being an Authorized User?

Having a “joint credit card” can easily be confused with having an “authorized user,” but they’re actually not the same.

Which one is better and what’s the difference?

An “authorized user” is someone that you can add to your account that you authorize to make purchases by simply calling the credit card issuer to add this user. The card issuer will mail a card to the newly added authorized user with their name on it, without a credit check.

An authorized user technically has no legal obligation to pay anything back; the account is held by you solely. That means the authorized user can rack up purchases and you have no recourse if they can’t pay it back. ☹ Good news is, you can always remove an authorized user from your account. 😊

A “joint card,” on the other hand, means that you will be sharing the account equally with equal payment obligation.

To open a joint account, both account holders will be required to have a credit check. And the two of you must apply for the account together. You can't add a joint account holder to an account that's already open. Well, that’s the case with most banks, though Bank of America and US Bank will sometimes allow you to add a joint account holder to an existing account. And since you are both equal account holders, one cannot be removed.

Scored Credit™ also found that joint accounts are counted in all FICO models as your own card. And while people get turned down for credit cards after being added as an authorized user, they are being approved when they are a joint account holder.

|

Authorized User |

Joint Card |

|

|

Credit Check |

Not Required |

Required |

|

Add to an existing account |

Always |

Only some banks |

|

Payment Obligation |

Zero |

Equal |

Join Credit Cards: Key Takeaways

These are all things to consider when deciding on a joint credit card vs. authorized users.

And don't forget: With a joint account, you acquire the good history of your partner which is a given to building your credit.

If you want to get a joint card with your partner, it’s key to know the Pros and Cons of joint credit card accounts first.

Getting a joint card can be convenient but it also carries some risks, so make sure you and the joint account holder stay in touch about what is expected—so you can keep your credit and your relationship intact.

While being added as a joint account holder to someone with solid credit is one of the best ways to boost your score fast, there are more ways that might help you. Check out these articles on ways to build credit.