In this Post:

- Subprime Credit Cards: A Breakdown

- Go from Bad to Good Credit

- Aspects to Keep in Mind

- How to Best Utilize Subprime Credit Cards

- Recommended Subprime Credit Cards

- The Answer to Bad Credit

In life, there are certain numbers that have a certain significance.

At 16,

you can gain a new independence and be behind the wheel and drive where your heart desires.

At 18,

you can use your voice and start voting.

At 21,

you can legally take your first drink. (Drank before that? Shhh, I won’t tell.)

All of these numbers open up several opportunities. In your financial life, there’s another number that’s just as important:

Your three-digit credit score.

This can open other doors for you as well, such as getting approved for a home loan, or car loan, when you really need it.

But if your credit isn’t so hot? You might be out of luck.

So, what can you do if your credit sucks ☹ and you want to properly adult?

You might consider opting for a subprime card.

Here’s your guide on everything you need to know about subprime cards.

A Closer Look at Subprime Credit Cards

When you hear the word “subprime” you might be like, “What does that even mean?”

Well, it’s important to understand what the term “subprime” means by first defining what “prime” means.

The word “prime” is associated with good credit. You know when you hear “someone’s in their prime,” they typically mean they’re at their peak—their A-game.

Consumers who fall into the range of prime credit are typically offered competitive rates, alongside the best credit cards that are chock full of perks.

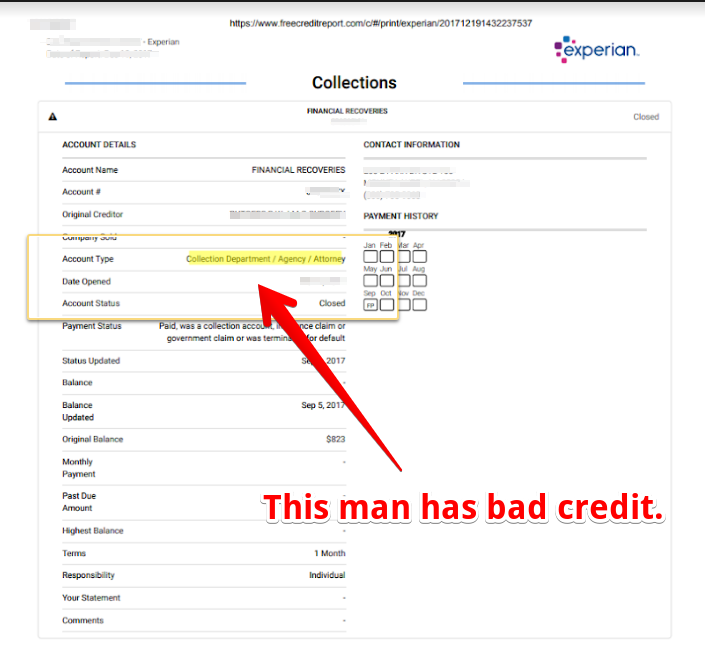

On the other hand, the term “subprime” refers to less-than-ideal credit and means your credit is below the mark that is considered attractive to lenders. A subprime credit card usually comes from a less prominent lender who is ready to take the risk of granting credit at a greater risk of not getting repaid.

There’s a specific market of credit cards that are geared toward consumers with subprime credit. These cards don’t come with as many perks as other credit cards on the market and tend to have:

- much higher fees

- lower credit lines

- sometimes, no grace period

Yet, they’re not all bad news.

How Subprime Credit Cards Can Lead to Good Credit

If you have no credit or bad credit, it can be tough to get approved for any type of loan or credit. So, how in the world can you improve your situation?

“What credit cards can you get with bad credit?”

“What credit cards can you get with no credit at all?”

Subprime credit cards, when used the right way, can help be a stepping stone to good credit. Subprime credit cards are a good option if you’re looking to rebuild your credit after any delinquencies, bankruptcy, etc. Though these cards can help you establish credit as well, it’s important to be aware of the higher fees and interest rates than with prime credit cards. In other words, while subprime cards are good options for rebuilding and establishing credit, it might work better if you need a credit makeover.

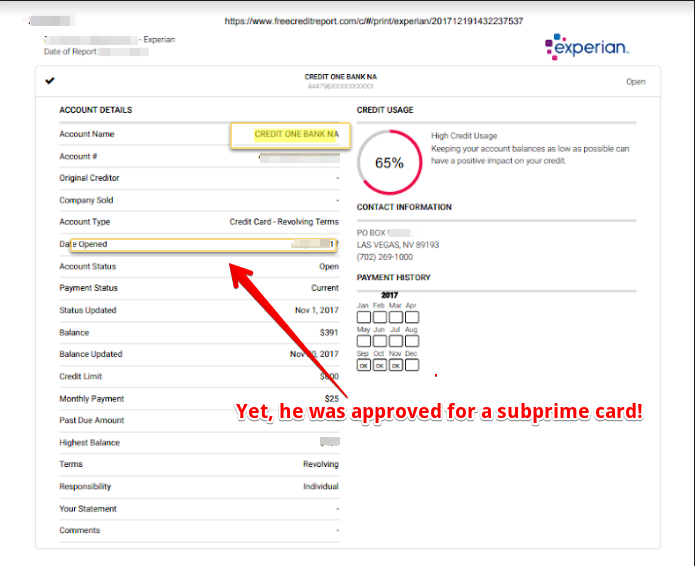

Subprime credit cards typically have an easy approval process. If you get approved for a subprime credit card and use it properly, you may be able to rebuild or establish your credit.

Two key ways to build credit:

- make on-time payments

- keep your credit utilization low

Even though subprime credit cards aren’t ideal, they can be an option for those who don’t have many options to consider. It can be a new path, to start again. They really only become an issue if you don’t pay on time; then you’ll end up paying higher fees and interest.

A secured card can also be an option. Although the secured card might be declined for a person with a very bad history, it might work. It's worth to try.

Things to Consider About Subprime Credit Cards

Subprime credit cards can be a great gateway to rebuild or establish credit. But... because they are “subprime” you will end up paying the price for this privilege. These credit cards have much higher interest rates than prime credit cards and may have annual fees associated with them.

The good news is that some of them may not even have a credit check, which can make them more accessible.

However, you likely won’t have all the perks prime borrowers get and you may end up paying more in the long run.

Tips for Using Subprime Credit Cards

If you’ve recently been rejected for a credit card because of your credit, choosing a subprime credit card may be a better fit.

Once approved, make sure you make all of your payments on time and keep your balances low.

To make the most out of subprime credit cards, you want to make your payments on time and in full every month. Not only that, but you want to keep your credit utilization low. Your credit utilization is the amount of credit that you use, which ends up on your monthly statement. Your lender keeps tabs on how much credit you use. If you use too much of it, it could be a signal to lenders that maybe you need credit a little too much.

Ideally, you want to keep your credit utilization 30% or below. In other words, if your credit limit is $3,000, you’d want to have $900 or less on your credit card throughout the month. If you end up charging more, you should consider making multiple payments throughout the month.

Scored Credit™ has seen many people being approved for regular prime cards after having subprime cards for even less than a year.

After six months, you should have enough payment history to upgrade and apply for a prime card that has

1. better rates,

2. fewer fees, and

3. no deposits

That is the way you can use the power of subprime credit cards, graduate to a better card, and take the next step on your credit journey.

After having prime cards, it should be smart to close the subprime card. It's not worth its fees.

However, sometimes it's good to keep it open for a while until you have enough age on prime credit cards to keep your report strong.

The Subprime Credit Cards with Rave Reviews

If you have less-than-ideal credit, there are a variety of subprime credit cards that are on the market that might be a good fit for you.

1. Open Sky Secured Visa—best for no credit check.

2. primor® Visa Secured Card (BerkshireBank)—low interest rates.

3. UNITY VISA SECURED CREDIT CARD—good for rebuilding credit.

4. primor® Secured MasterCard Gold Card—no minimum credit score needed to apply.

Your Answer to Repairing or Building Credit

Subprime card issuers are here for you if you have poor or no credit. Being that they have high fees (like application fees), high annual fees, and sometimes no grace periods, the good credit user will opt for a prime card.

Subprime cards are the best and easiest, yet unfortunate, option for anyone looking to build and repair their credit. There are more ways that might help you. Check out these articles on ways to build credit.